In just two days, Bitcoin will undergo its fourth mining-reward halving, slashing the per-block emission from 6.25 BTC to 3.125 BTC.

This event, occurring every four years, will significantly slow down the pace of new supply. Historically, previous halvings have been followed by extensive multi-month rallies in BTC, leading the crypto community to anticipate a similar outcome this time.

However, the massive investment bank Goldman Sachs advised its clients not to extrapolate from previous half cycles.

Goldman’s Fixed Income, Currencies and Commodities (FICC) and Equities team stated, in a note to clients on April 12, “Historically, the previous three halvings have been accompanied by BTC price appreciation after the halving, although the time it took to reach the all-time highs differs significantly. Caution should be taken against extrapolating the past cycles and the impact of halving, given the respective prevailing macro conditions.”

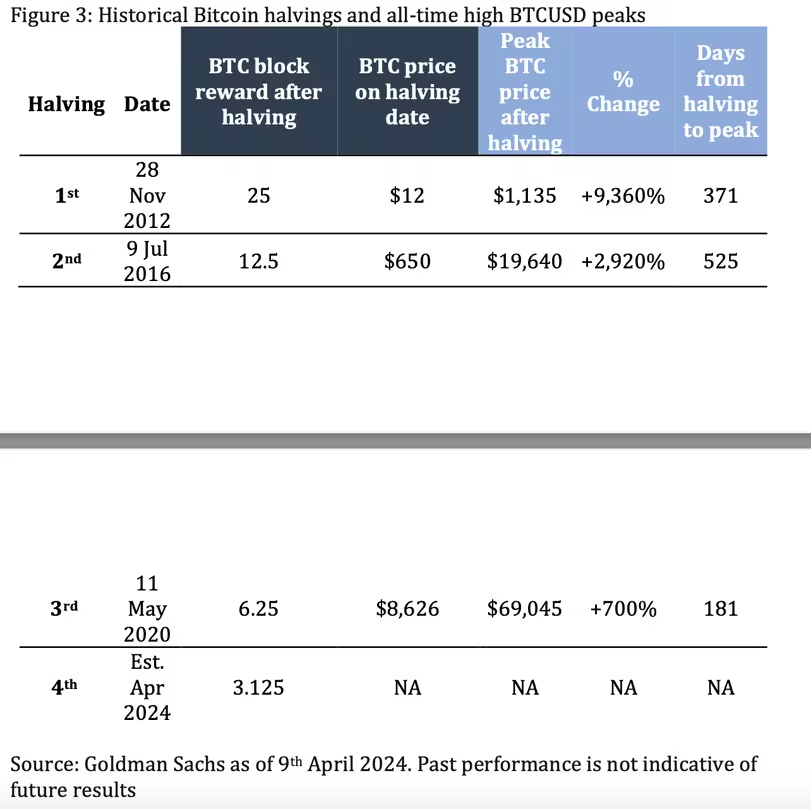

The performance of Bitcoin following its prior halvings on November 28, 2012, July 9, 2016, and May 11, 2020, is depicted in the graphic. Even after each of the three halvings, bulls remained in control, but the size and duration of the final peak varied.

More significantly, the macroeconomic situation back then was different from the high inflation and high-interest rate environment of today. Last year, the M2 money supply of the major central banks at the time, including the People’s Bank of China, the European Central Bank, the Bank of Japan, and the U.S. Federal Reserve, rose quickly.

In the developed world, interest rates were locked at or below zero, which encouraged risk-taking in the financial sector overall and in cryptocurrencies in particular.

Goldman claims that the halfing of Bitcoin is a “psychological reminder to investors of BTC’s capped supply,” and that the adoption of the ETFs will determine the medium-term prognosis.

“Whether BTC halving will next week turn out to be a “buy the rumour, sell the news event” is arguably less impactful on BTC’s medium term outlook, as BTC price performance will likely continue to be driven by the said supply-demand dynamic and continued demand for BTC ETFs, which combined with the self-reflexive nature of crypto markets is the primary determinant for spot price action,” the team stated.

Also Read: Crypto Market Underestimates Bitcoin Halving’s Impact: Bitwise