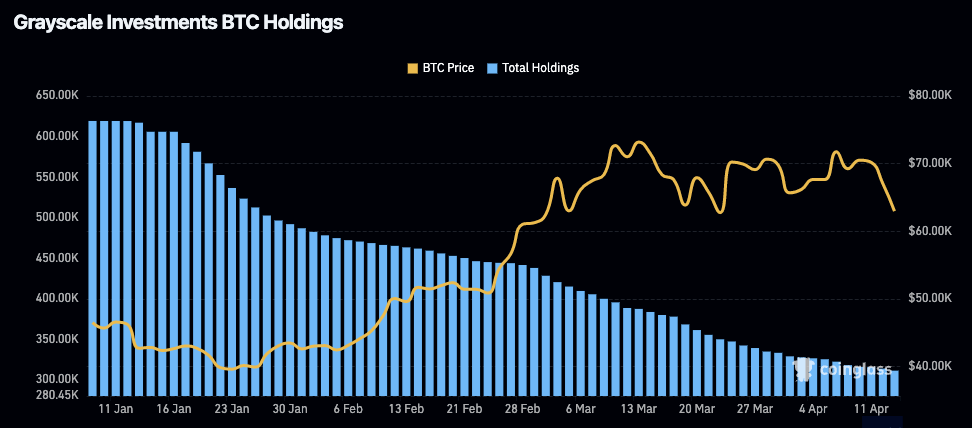

Grayscale Investments, a leading Bitcoin investor has seen a 50% drop in its spot Bitcoin ETF ahead of Bitcoin halving. The GBTC plunged by half from 619,220 BTC on the first day of its trading on Jan. 11.

On April 16, the 66th day of the spot Bitcoin ETF had 309,871 BTC, currently valued at $19.5, which was a 50% drop since the debut, according to the Coinglass data.

This happened just before the much-anticipated Bitcoin halving, where the rewards for Bitcoin miners are also cut in half to reduce supply in the market.

The Bitcoin halving happens every four years or so and is usually followed by a surge in the value of Bitcoin and other cryptocurrencies.

Investors have been exiting GBTC since the launch of competing Bitcoin ETFs. One reason for this sell-off is that GBTC had high fees compared to other Bitcoin investment options in the US. Most of these options were lowering their fees to attract more investors, while GBTC’s fees were around 1.5%, much higher than the others which were around 0.2% to 0.4%.

Despite Bitcoin’s price climbing since the launch of spot ETFs, Grayscale’s Bitcoin Trust (GBTC) has seen a smaller decline in its dollar-denominated assets under management (AUM). As of today, GBTC’s AUM sits at $19.8 billion, reflecting a 31% drop from its $28.7 billion peak on January 11th.

This suggests that while investors have moved some holdings out of GBTC, the overall value of their holdings hasn’t fallen as dramatically due to Bitcoin’s price appreciation.

BlackRock’s IBIT and Fidelity’s FBTC spot ETFs have been the primary beneficiaries in terms of market share by bitcoin holdings.

Also Read: Spot Bitcoin ETFs See $58M Outflows in Last 24 Hours