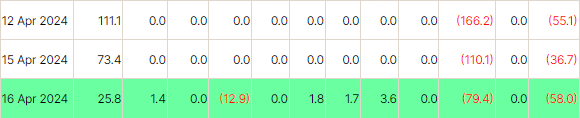

On Tuesday, April 16, spot Bitcoin ETFs saw net outflows of $58 million, continuing a two-day consecutive decline as reported by Farside Investors, indicative of subdued market activity.

Despite this trend, there are signs of improvement. Outflows from the Grayscale Bitcoin ETF GBTC slowed down to $79.4 million on April 16, with total outflows reaching $16.46 billion. Additionally, Ark Invests’ Bitcoin ETF ARKB saw negative outflows of $13 million.

While outflows from GBTC have eased, so have inflows into spot Bitcoin ETFs. On the same day, BlackRock’s IBIT recorded the highest net inflow at $25.78 million, surpassing $15.3 billion in total inflows.

Bloomberg ETF analyst James Seyffart notes that zero-inflow days are common in ETFs, including Bitcoin ones, and shouldn’t be seen negatively.

In ETFs, shares are created or eliminated in batches (creation units) based on supply and demand disparities, with transactions only occurring if costs are favorable compared to traditional methods.

Also Read: BlackRock Bitcoin ETF Sees $73.4M Inflows Despite Drop