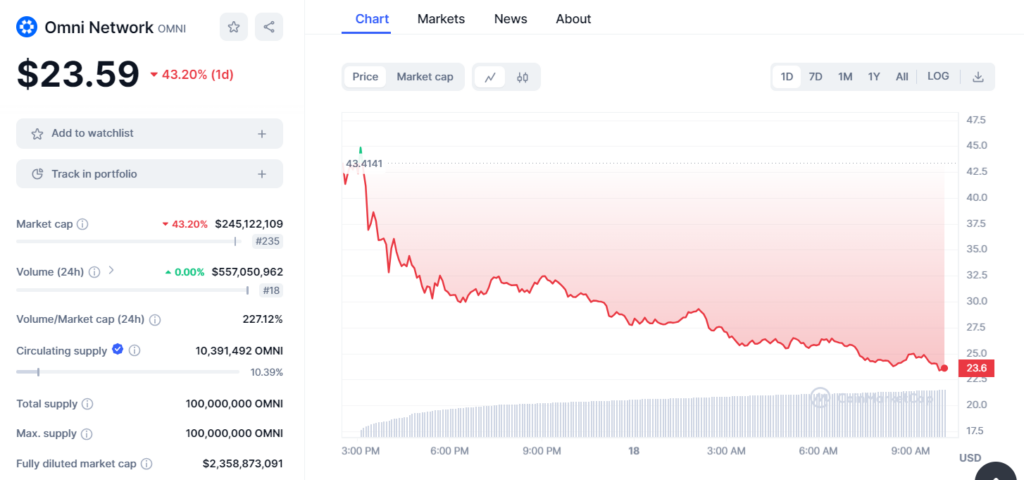

The Omni Network’s native token, OMNI, experienced a significant price drop of nearly 55% on Wednesday following its airdrop and listing on major cryptocurrency exchanges. The token’s value tumbled from $53.80 to around $24 within hours of trading.

Omni Network, a blockchain platform aiming to integrate Ethereum rollups, conducted an airdrop of 3 million OMNI tokens, representing 3% of its 100 million token supply, to community contributors on April 17. The airdrop coincided with OMNI’s listing on exchanges like Binance, ByBit, and Bitget, with initial trading starting around $53.81.

Contrary to expectations for a spike like ENA and EtherFi, OMNI’s value dropped sharply. Investors may have sold the airdropped tokens to collect liquidity, contributing to the steep decline. The token’s trading volume reached approximately $830 million.

In the wider crypto market slump, potentially influenced by tensions surrounding a potential Iran-Israel conflict, OMNI token prices fell by 55% on Wednesday after listing on major crypto exchanges, such as Parcl (PRCL) on Solana and Wormhole’s X token, which has lost $1.5 billion in market cap since launch.

As the crypto market faces volatility, the response to the OMNI airdrop underscores how investor sentiment can affect new tokens. A commentator on X explained, “People have been struggling financially, so they quickly sell any airdrops they receive to access cash in this fear-driven market.”

Also Read: TON Foundation Airdrops 300,000 Toncoin to Meme Coin Traders.