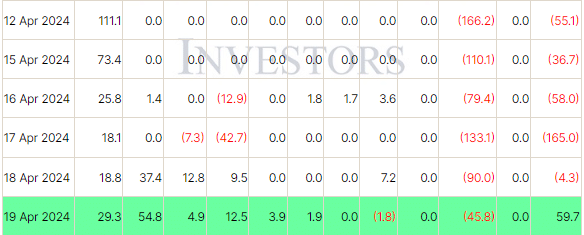

Amidst anticipation of a post-halving value surge, Bitcoin ETF investments in the US turned positive, halting five days of outflows with $59.7 million inflows on April 19, led by FBTC gaining $54.8 million, as reported by Farside Investors.

This positive trend contrasts with previous outflows, mainly from the Grayscale Bitcoin Trust ETF (GBTC), due to SEC approvals for spot Bitcoin ETFs. Notable inflows came from Bitwise Bitcoin ETF (BITB), ARK 21Shares Bitcoin ETF (ARKB), Invesco Galaxy Bitcoin ETF (BTCO), and Franklin Bitcoin ETF (EZBC).

The Bitcoin block 840,000, marking the fourth-ever halving on April 20, spiked network fees, with users spending 37.7 BTC (over $2.4 million) to secure space.

The previous halving in 2020 saw Bitcoin’s value soar from $8,500 to about $69,000 in two years. This surge in ETF investments hints at a bullish sentiment post-halving, reflecting investor confidence in Bitcoin’s potential growth.

Investors’ increased Bitcoin ETF investments signal a bullish outlook post-halving, reflecting confidence in Bitcoin’s growth potential.

Also Read: Bitcoin Prices Set to Surge After Bitcoin Halving: Bitwise CIO