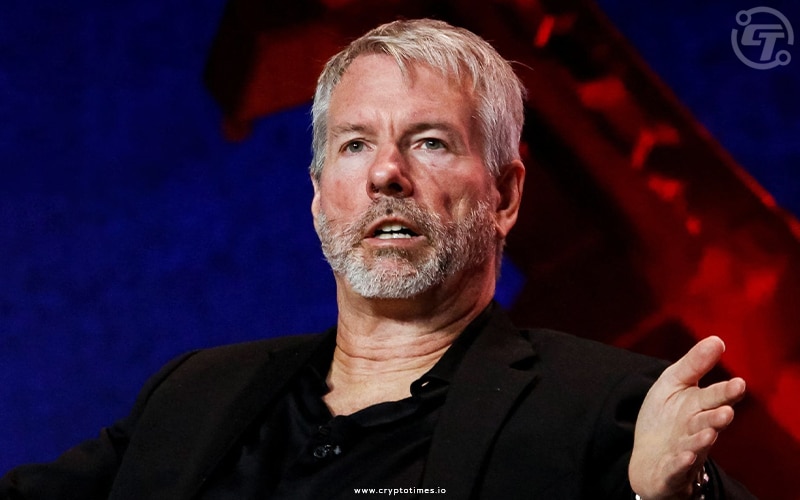

Michael Saylor, the brain behind MicroStrategy, has scored big as he cashed in a whopping $372.7 million by selling 370,000 shares this year, making up over 90% of what was planned.

Using a smart strategy known as a 10b5-1 plan, Saylor could sell up to 5,000 shares daily from January to April, linked to a vested stock option set to expire by April 30, 2024. Now, he’s left with just 30,000 shares after his latest sale.

Under the agreement, he has the authorization to unload up to 400,000 shares until April of this year.

Despite a 37% dip from its March high, MicroStrategy’s stock has been a star performer, shooting up 91% this year after an incredible 346% jump in 2023.

Michael Saylor, MicroStrategy’s major stakeholder, boasts $2.3 billion in Class B shares. With an additional 400,000 Class A shares from the 2014 option, he’s swiftly liquidating. This discreetly revealed plan, unveiled in November’s third-quarter earnings report, has sparked intrigue.

Despite sizable stock sales, Saylor’s fortune predominantly resides in MicroStrategy’s Class B shares. Further enhancing his wealth is the stash of 17,732 Bitcoins acquired in 2020, now valued at around $1.1 billion.

In the meantime, MicroStrategy has accumulated over 214,000 BTC since 2020. These assets, constituting roughly 1% of the total existing BTC supply, are now valued at approximately $13.6 billion.

Also Read: MicroStrategy Faces $1.92B Loss from Short Sellers in Crypto