After the Bitcoin halving, U.S. crypto stocks saw 20% gains, with the ascent being fueled by a general market upswing.

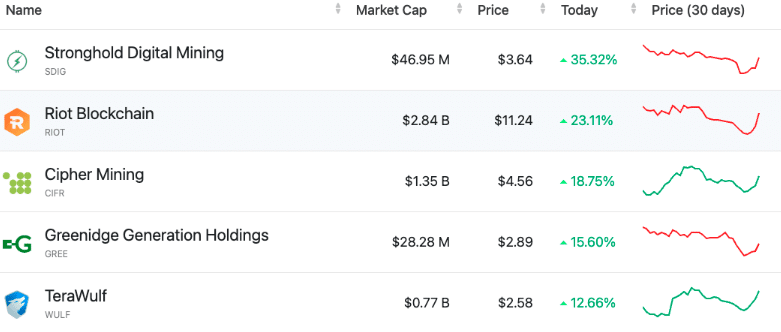

On April 22, the top gainers were Marathon Digital (MARA), CleanSpark (CLSK), Phoenix Group (PHX.AE), Riot Platforms (RIOT), Cipher Mining (CIFR), and Hut 8 (HUT), which all had around 20% growth. SDIG (Stronghold) broke the rank with a 35.3% increase, while Riot was close behind with a 23% gain.

Valkyrie Bitcoin Miner ETF (WGMI), which includes mining stocks as well as chipmakers such as NVDA (Nvidia), also experienced an 11% rise. Profits from mining the currency were not as low as initially thought to be as the mining reward halved to 3.125 BTC per block.

Investment analysts attribute the rise of the Nasdaq Composite and the S&P 500 by 1.1% and 0.8%, respectively, to the de-escalation of the situation in the Middle East and the upcoming earnings reports of tech firms. Yet long-term risks such as inflation rates, rising bond yields, and the possibility of a Fed rate adjustment dampened the market.

Consequently, the price of Bitcoin itself even rose by 4.2% following the halving, reaching $66,620. Notably, Coinbase and MicroStrategy also benefited from a positive movement, while the crypto market bulls supported the bullish sentiment in the market.

Also Read: Bitcoin Halving Impact: $206M Outflows from Blockchain Stock