Bitcoin surged past $66,000, even teasing $67,000 briefly before pulling back. However, this quick pullback left bulls and traders with over-leveraged long-position liquidations, with over $249.5 million lost in one day.

But let’s not forget about altcoins. Many of them dropped even more than Bitcoin did.

Last week was wild for Bitcoin. It dropped below $60,000 twice because of tensions between Iran and Israel. But when Iran said they were taking a break, Bitcoin bounced back to around $65,000 after the fourth halving.

On Tuesday and Wednesday, Bitcoin’s value climbed above $67,000, only to fall back quickly. After that, it dropped to $64,500, then even lower to under $63,600. Right now, it’s still in the red, just above $64,000.

Other cryptocurrencies like Solana, Toncoin, Dogecoin, Avalanche, and Shiba Inu also went down, some by 7% to 10%.

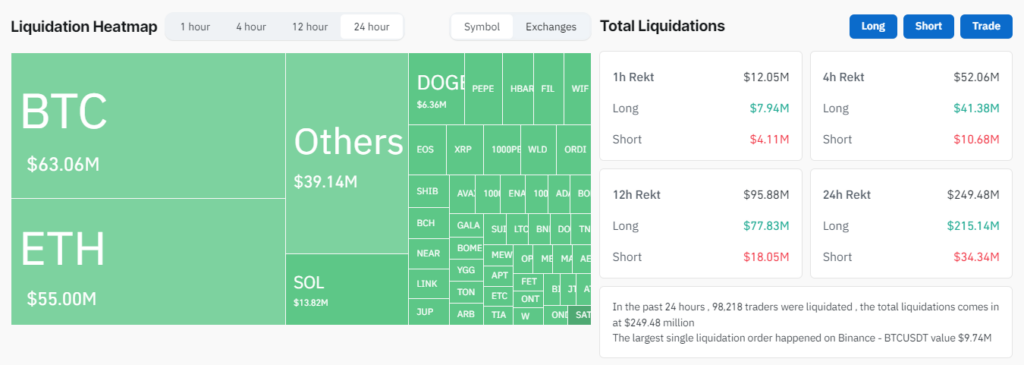

Almost 98,218 traders lost money in the past day, especially those who were betting on prices going up. The total losses reached over $249 million with the liquidation of $215 million in longs, according to CoinGlass. The largest single liquidation order happened on Binance, with a BTCUSDT value of $9.74 million.

Bitcoin’s rapid rise and fall, along with altcoins, caused significant losses for traders due to over-leveraging, highlighting the volatility of the crypto market. Volatility in Bitcoin and altcoins raises concerns. Are investors prepared for such rapid swings?

Also Read: Janet Yellen Linked ‘Buy Bitcoin’ Notepad Sells for 16 BTC