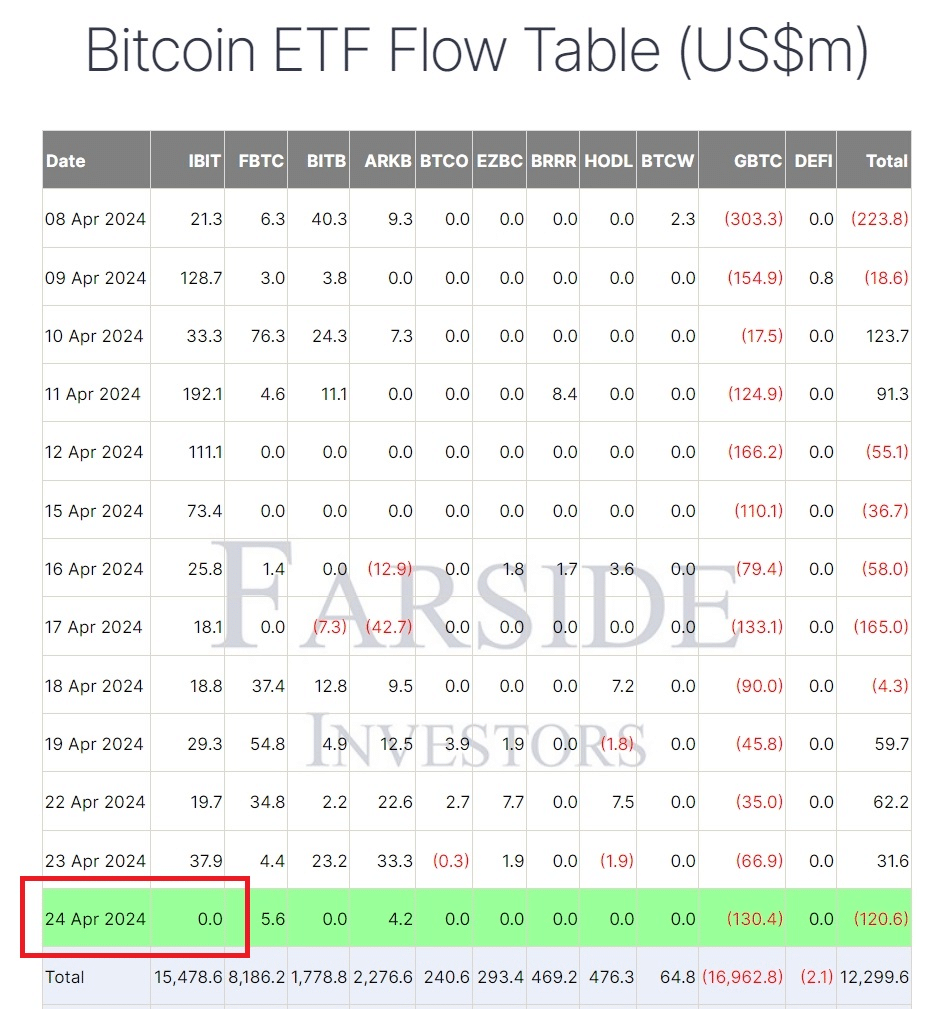

The BlackRock iShares Bitcoin Trust (IBIT) experienced its first day without any new investments, with $0 inflows, according to data from farside.co.uk, since the introduction of Bitcoin ETFs in the United States this January.

This marked a significant shift, as IBIT had previously accumulated nearly $15.5 billion over 71 days and entered the list of the top 10 ETFs. On April 24, the Fidelity Wise Origin Bitcoin Fund received $5.6 million, while the ARK 21Shares Bitcoin ETF saw $4.2 million in inflows.

On that day, the Grayscale Bitcoin Trust ETF saw $130.4 million in withdrawals. This resulted in a net outflow of $120.6 million across all spot Bitcoin ETFs.

Overall, the U.S. Bitcoin ETF market has amassed $12.3 billion in Bitcoin since January 11. Despite these inflows, the cumulative outflows from the Grayscale Bitcoin Trust, which exceed $17 billion, have significantly impacted the total gains.

In the regulatory landscape, several market participants are applying to launch Ether ETFs. However, their approval has been delayed as the Securities and Exchange Commission reviews the applications.

Also Read: Hong Kong to Debut Spot Bitcoin, Ether ETFs on April 30