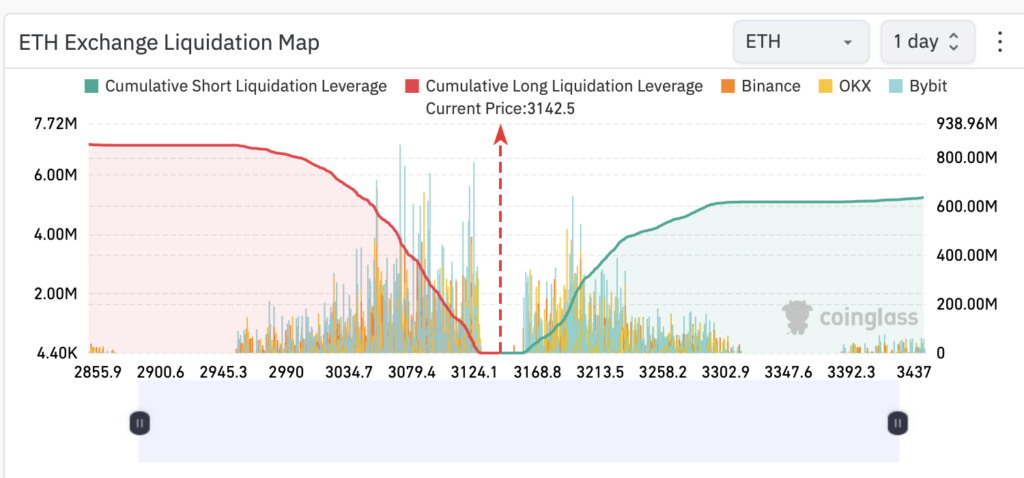

Over half a billion dollars in Ether’s long positions are on shaky ground as the cryptocurrency market braces for potential volatility. With Ether currently trading at $3,141, any significant price swings could trigger massive liquidations, reminiscent of recent weekends.

The looming specter of a rejected Ether spot ETF by the U.S. Securities and Exchange Commission (SEC) adds further uncertainty. Investors fear the consequences if the ETF proposal faces rejection next month.

Recent weekends have seen Ether’s price rollercoaster. On April 20, it dipped by 2.25% to $3,036, and the previous Saturday, it plummeted nearly 9% to $2,950 before bouncing back to $3,075.

Should history repeat itself this weekend, we’re looking at potentially catastrophic liquidations. Even a modest 2.25% drop from its current price could spell $510 million from long liquidations. But if the market sees a sharper decline akin to the 9% drop from the previous weekend, we could witness a staggering $853 million being wiped out.

In addition to all this drama, there’s a lot of uncertainty about Ethereum’s future. People are waiting anxiously for news about whether a special investment fund for Ethereum will be allowed. There are also some legal fights going on.

Investors are nervous, keeping a close eye on what’s happening in the markets and with the rules to figure out what might happen with Ethereum.

Also Read: Standard Chartered Remains Bullish on Crypto Despite Ether ETF Delay