Forget the stodgy suit-and-tie advisors and dusty investment manuals! Gen Z and Millennials are tossing out the old financial playbook. Their wallets are buzzing with a different kind of currency – Bitcoin, Ethereum, maybe even a rare CryptoPunk NFT. This isn’t just a fad; it’s a full-blown revolution.

While older generations might scoff at these digital assets, this tech-savvy crew is building their financial futures on a foundation of innovation and adaptability.

Dive deeper and discover the trends driving this shift, from skyrocketing crypto adoption to the challenges of real estate ownership, and see how Gen Z and Millennials are redefining what it means to be financially secure.

Crypto Adoption by Gen Z

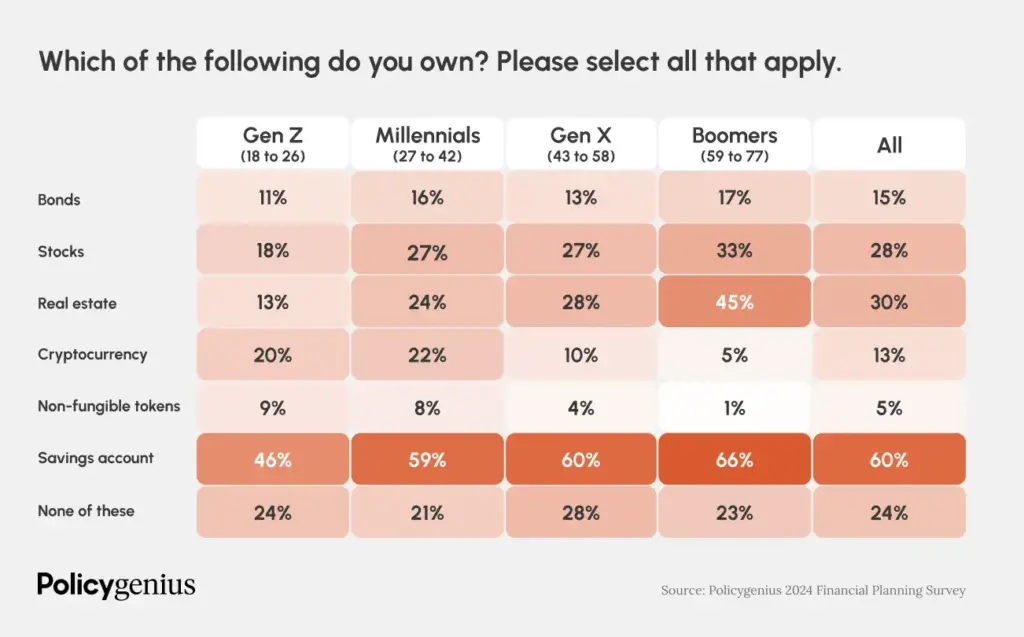

Forget stocks and bonds, Gen Z and Millennials are saying “Crypto to the moon!” A recent Policygenius survey [Policygenius 2024 Financial Planning Survey] revealed a generational divide in investment preferences. While only 10% of Gen X and a measly 5% of Baby Boomers dabble in crypto, a whopping 22% of Millennials and 20% of Gen Z are diving headfirst into this digital asset class.

This trend isn’t surprising. Platforms like Xcoins are making it easier than ever to buy Bitcoin with credit card no verification. This accessibility, coupled with the tech-savvy nature of younger generations, is fueling the crypto adoption fire.

Interest in Non-Fungible Tokens (NFTs)

Digital art? Collectibles? Investment opportunity? It’s all about NFTs for Gen Z and Millennials! According to the Policygenius survey, a smaller but significant portion of these generations (9% of Gen Z and 8% of Millennials) are diving into the world of NFTs. These digital certificates of ownership for everything from artwork to sports highlights are traded on platforms like OpenSea and Rarible.

This trend highlights the generational gap in understanding and embracing new technologies. While Baby Boomers and Gen X remain largely on the sidelines, younger generations see NFTs as more than just digital trinkets. They represent a new frontier for both cultural expression and potential financial gain.

Take Chainers, for example. This one-stop web 3.0 game lets you collect free NFTs daily! Not only can you own these digital assets, but you can also use them to play, socialize with others, create unique AR content, and even trade them within the game’s ecosystem. Chainers exemplifies how NFTs are evolving beyond static images and becoming versatile tools for engagement and potential value creation.

The American Dream on Hold: Why Owning a Home is Tougher for Young Adults

For Gen Z and Millennials, the classic path to wealth through homeownership seems to be blocked. The Policygenius survey shows a stark contrast – only 20% of both generations own real estate compared to previous generations at their age.

So what’s the deal? Blame it on a triple threat: sky-high interest rates, stagnant wages, and a housing market with more competition than a limited-edition sneaker drop.

But Wait, There’s More! How Young Adults are Getting Creative with Their Money

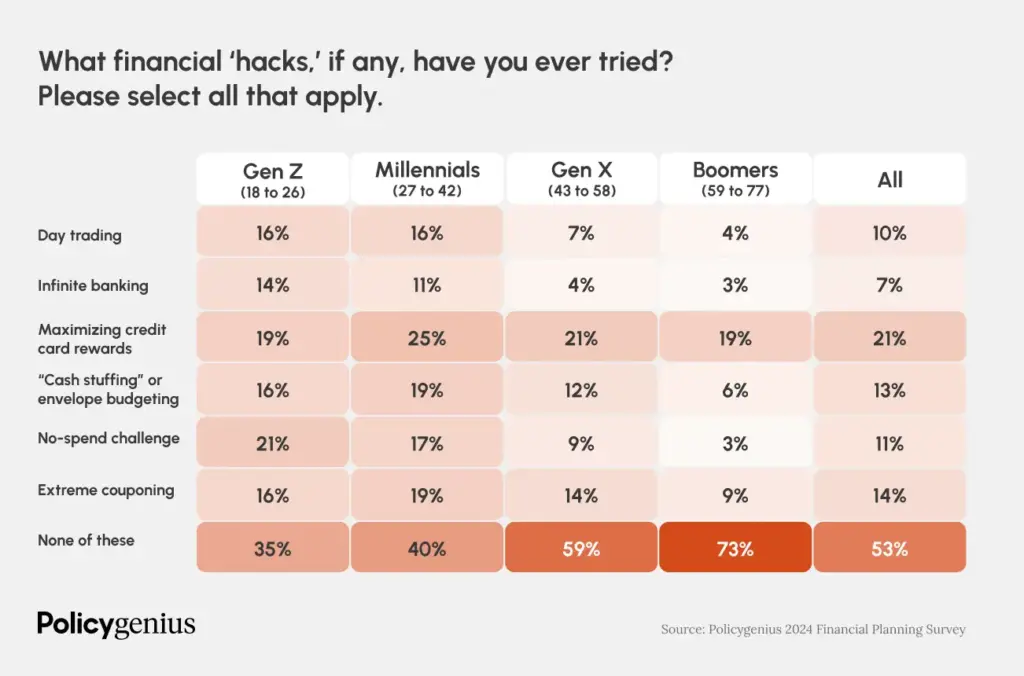

Faced with these hurdles, Gen Z and Millennials are proving their financial resourcefulness. They’re ditching the traditional playbook and embracing innovative strategies. Day trading (though risky, so proceed with caution!) and “no-spend challenges” to tighten their belts are becoming popular tactics.

One strategy that transcends generations is the art of maximizing credit card rewards. Swiping strategically for everyday purchases or even using them for sports bets (where legal) can rack up points and miles that translate to free flights, hotels, or statement credits. It’s all about getting the most bang for your buck, no matter your age!

By thinking outside the box, these younger generations are reshaping personal finance. Their openness to digital assets like crypto and NFTs, combined with their savvy budgeting techniques, show a new approach to building a secure financial future.

The Future of Finance: Owned by the Young and Restless

The financial landscape is undergoing a dramatic transformation, driven by the tech-savvy and adaptable Gen Z and Millennials. Their preference for digital assets like cryptocurrencies and NFTs, coupled with innovative budgeting strategies, reflects a significant shift in how younger generations approach wealth building.

While challenges like high housing costs persist, their willingness to embrace new technologies and unconventional strategies positions them well to navigate an ever-changing economic environment. As they continue to redefine financial norms, one thing is certain: the future of finance is in the hands of the young and restless.