In the world of Bitcoin predictions, two seasoned traders are offering different takes on where the cryptocurrency’s price is headed.

Veteran trader Peter Brandt suggests Bitcoin may have already hit its peak this cycle, reaching around $70,000 in March. Brandt’s theory revolves around an “exponential decay” pattern, where each bull market cycle sees a peak price that’s about 20% of the previous cycle’s peak.

He estimates this cycle could only see a 4.5x gain from its low, pointing to $70,000 as the peak. However, he’s only about 25% convinced by his theory.

Brandt added, “Worded another way, 80% of the exponential energy of each successful bull market cycle has been lost.”

On the other hand, Giovanni Santostasi, CEO and Director of Research at Quantonomy, offers a different perspective. He argues that Brandt’s theory lacks solid statistical evidence due to the limited data points.

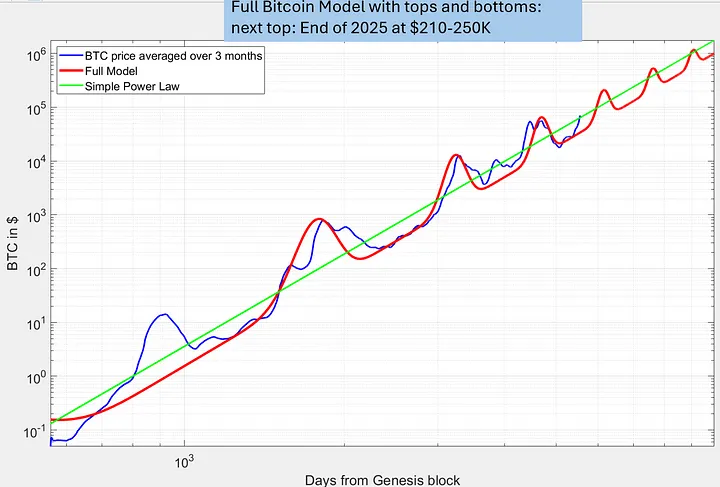

Instead, Santostasi proposes a power law model, which suggests a different pattern. In simple terms, a power law describes how one thing changes with another over time, in this case, Bitcoin’s price. Santostasi’s model implies that Bitcoin could reach much higher than $70,000 before this cycle ends.

Commenting on Brandt’s theory, he said, “We have only 3 data points if we exclude the pre-halving period and actually only 2 data points if we consider the ratios. This is hardly enough data to do any significant statistical analysis.”

Based on data from the genesis block, the price model forecasts that by December 2025, there could be a peak of approximately $210,000 in the fourth cycle. It also suggests that the bottom for the next cycle might be around $83,000, drawing from past trends.

So, while Brandt’s theory is intriguing, Santostasi’s counterargument suggests that Bitcoin’s journey might still have some big surprises in store.

Is Bitcoin’s future peak at $70K or $210K? Brandt’s “exponential decay” vs. Santostasi’s power law. Which model will prove to be accurate?

Also Read: Bitcoin Solo Miner Wins 3.125 BTC Lottery with Valid Block