In the week ending April 26, 2024, Bitcoin Spot ETFs in the U.S. faced significant net outflows totaling $328 million, as reported by Farside Investors.

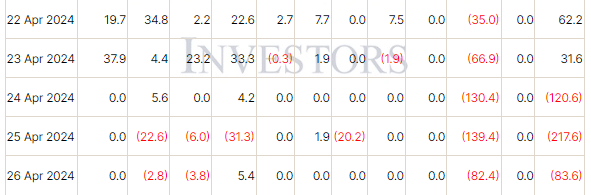

On April 22, there were $62.02 million in net inflows, with Grayscale’s GBTC seeing outflows of $35 million and Fidelity’s FBTC gaining $34.8 million. BlackRock’s IBIT ETF also had a $19.7 million inflow.

On Tuesday, April 23, Farside UK data showed net Bitcoin ETF inflows of $31.6 million, led by BlackRock’s IBIT and Ark 21Shares’ ARKB. Wednesday saw net outflows of $120 million, with GBTC leading the outflows.

By Thursday, outflows intensified to $217 million across all 10 Spot Bitcoin ETFs, led by GBTC’s $139.4 million outflow. Friday showed continued outflows, totaling $83.6 million, except for ARKB, which had a $5.4 million inflow.

Investor concerns grew amid a crypto market sell-off and the DTCC’s new collateral valuation rules for BTC ETFs, causing unease. These developments reflect a volatile period for Bitcoin ETFs, likely influencing broader market sentiment.

The scene is uncertain, with potential reversals in ETF flows expected as Bitcoin faces increased volatility and potential downward trends.

Also Read: ARK Dumps ProShares Bitcoin ETF Shares in Massive Sell-Off