Pike Finance is a DeFi lending protocol that got caught in the debacle of a smart contract exploit that suffered huge losses, with $1.68 million taken from the system across the chains of Ethereum, Arbitrum, and Optimism on April 30.

Pike Finance commented on the incident, “This misalignment caused the contract to behave as if it was uninitialized since the *initialized* variable could no longer be accessed. As a result, attackers were then able to upgrade the spoke contracts, bypassing admin access, and as a result, withdraw funds.”

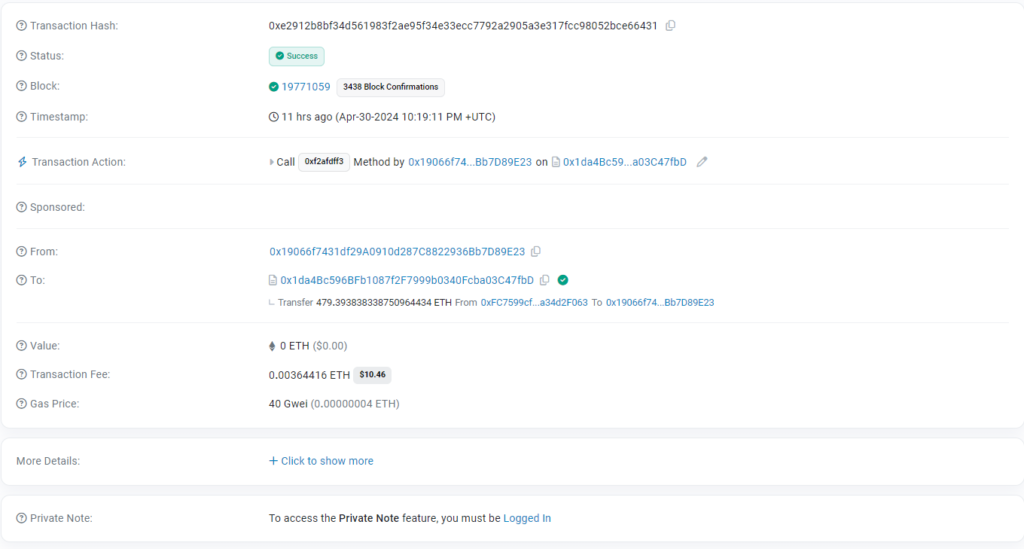

This allowed the hacker to manipulate the smart contract in siphoning funds, including $1.4 million in Ether, $150,000 of Optimism (OP), and over $100,000 worth of Arbitrum (ARB) tokens.

Pike also recently suffered a loss on April 26, when Pike Finance lost $300,000 to the same exploit. Pike Finance is offering a 20% reward for the return of the stolen assets or for information that leads to their recovery.

The protocol is continuing to investigate these security breaches to prevent future incidents. These repeated exploits underscore the persistent security issues in the DeFi sector and highlight the need for stronger protective measures for digital assets.

Also Read: DeFi Platform Hedgey Finance Suffers $44 Million Exploit