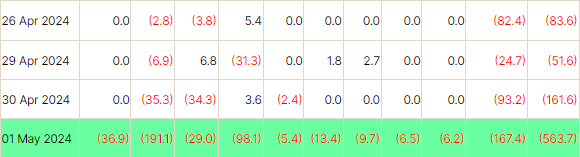

A major asset management company, BlackRock’s iShares Bitcoin Trust (IBIT) experienced its first-ever outflow day, with $36.9 million flowing out, marking a record for US Bitcoin exchange-traded funds (ETFs) on May 1.

Among the nine other Bitcoin ETFs, there were combined outflows of $526.8 million, with only the Hashdex Bitcoin ETF (DEFI) showing zero flows, according to preliminary Farside Investors data.

The Fidelity Wise Origin Bitcoin Fund (FBTC) recorded the largest outflow at $191.1 million, followed by Grayscale Bitcoin Trust (GBTC) with $167.4 million. These outflows coincide with a 10.7% decrease in the price of Bitcoin over the past week.

Nate Geraci, president of the ETF Store, noted that while gold ETFs like iShares Gold ETF and SPDR Gold ETFs experienced outflows of $1 billion and $3 billion this year, gold’s value has risen by 16% year-to-date.

Bitcoin ETFs’ significant outflows amid price volatility are a manifestation of an investor’s tendency to be more cautious, which is contrary to gold’s strengthening value despite outflows.

Bitcoin faced its toughest month since the downfall of Sam Bankman-Fried’s FTX empire, with excitement around US spot Bitcoin ETFs fading. Its value dropped by nearly 16% in April, slightly better than the decline seen in November 2022.

However, as optimism for Federal Reserve interest-rate cuts waned and risky investments lost appeal, inflows to these products decreased significantly.

Also Read: BlackRock Tokenized Fund BUIDL Receives $160M in Debut Week