Bitunix is a spot and derivatives trading platform that offers perpetual traders up to 125X leverage on assets.

Bitunix specializes in spot and derivatives trading, with more than 180 USDT margined contract trading pairs with up to 125X leverage and over 140 spot trading pairs.

Registered in Seychelles, Bitunix offers trading services in over 100 countries worldwide. The exchange has obtained operational licenses in multiple countries, including the U.S MSB license, Canada MSB and the Philippines VASP license.

Established in 2021, Bitunix has seen exponential growth since its launch; it has reportedly onboarded over 600,000 traders. According to the project, it generates over $1 billion in daily trading volume and achieved its highest trading volume in the first quarter of 2024. This growth data is proof of the growing adoption of Bitunix by cryptocurrency traders.

To establish itself as a leading firm in the crypto trading industry, Bitunix believes that better liquidity offers users a better trading experience.

Bitunix is a no-KYC crypto exchange that offers withdrawals of up to 500,000 USDT; however, to use Bitunix’s on-ramp crypto purchase services, where crypto can be purchased using credit cards, users will need to pass KYC.

Key Takeaways

- Bitunix is a spot and derivatives trading platform for cryptocurrency traders. It offers trading services for over 200 crypto assets and to investors in over 100 countries worldwide.

- Bitunix offers up 125X leverage for derivatives traders and boasts high liquidity and a tight spread. It also presents an intuitive user interface and claims to offer low trading fees as part of its goal to become a leading figure in the crypto derivatives trading market.

- Assets tradable on the Bitunix exchange include Bitcoin, Ethereum, Solana, BNB, and several other crypto assets.

Despite the proliferation of crypto spot and derivatives trading platforms, traders still seek better trading conditions. For derivatives traders, the possible leverage level is also a strongly considered factor as they wish to increase their chances of making a significant profit off a winning trade.

Existing trading platforms are putting considerable effort into solving these problems and developing the perfect platform for traders. Bitunix is one of these platforms and since its official launch, it has shown resilience in pursuing its mission and cementing its place in the competitive crypto derivatives and spot trading sector.

We take a closer look at the crypto exchange and what it offers;

Bitunix: A Spot and Derivatives Trading Platform

With leverage up to 125X for every asset tradable on the perpetual futures market, Bitunix offers traders an opportunity to maximize their profits. For derivatives traders using the platform, this is handy as it reduces the limits on possible profit that can be earned from a winning trade.

Bitunix claims to employ gilt-edge technologies in developing the algorithms used in its platforms. This includes the price feed system and the liquidation protocol. These systems are developed to maintain a sufficient level of accuracy and precision to ensure that the platform sustains its financial health and optimal operation. In addition to these, Bitunix does a lot more to improve the experience of traders that use its platform;

One of Bitunix’s biggest perks is its liquidity provisions. Spot and derivatives traders often resort to increasing their acceptable slippage levels while trading. This is due to the poor liquidity density on platforms where they trade. In low liquidity conditions, the gap between order book prices also tends to widen, causing a wider spread.

Bitunix claims to pool liquidity from a network of independent market makers, retail traders, and institutional investors to realize a liquidity-rich platform. By aggregating liquidity from multiple sources, Bitunix offers its users cost-effective trading through narrow spreads, minimizing the gap between bid and ask prices, and letting them capture favorable entry and exit points in their trades. With over 600,000 confirmed users, the order book is laden with orders from thousands of traders wishing to trade at very close price differences, further strengthening the liquidity on the exchange.

Bitunix also claims to run a market surveillance system to mitigate fraud and manipulations on its platform. It employs rigorous market surveillance protocols and advanced risk management systems to maintain a fair and orderly trading environment. This is in line with growing confidence among users and trust in the platform’s liquidity dynamics.

Features of Bitunix Exchange

Now, let’s look at other key features of Bitunix.

Deposit Through Various Blockchains

Bitunix supports several blockchain networks. Users can deposit funds through any of the supported blockchains. The multi-network support enables the platform to embrace different blockchain communities and simplify the deposit process for investors in any of these communities. Users can deposit assets via Ethereum, Bitcoin, Solana, Cardano, and other supported networks.

Spot and Futures Trading

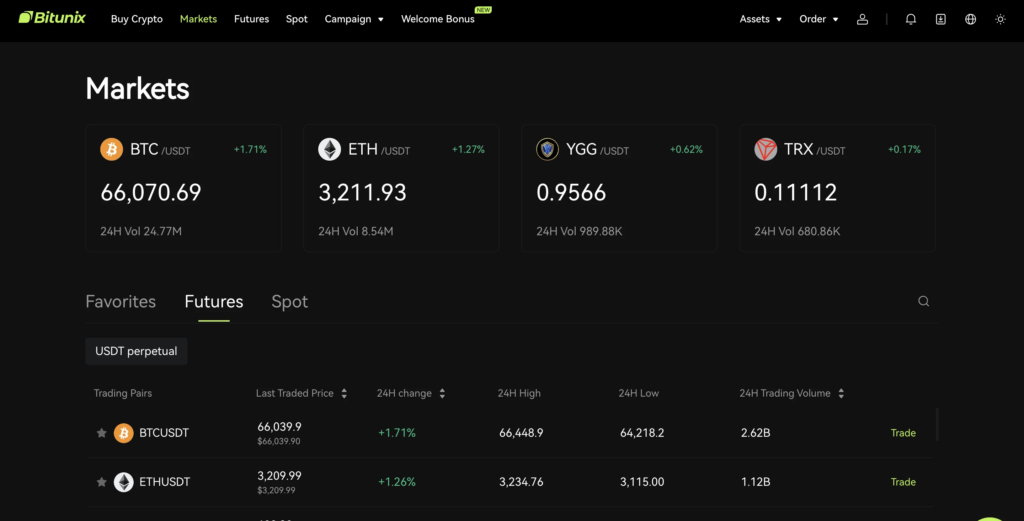

Crypto asset trading is the primary service offered on Bitunix. Users can place direct orders or limit orders on the spot trading platform. About 140 crypto assets are available for trading on the spot market. For derivatives traders, the Bitunix perpetual futures market features over 180 markets with crypto and stablecoin pairs. Users can trade these assets with up to 125X leverage and trade listed assets with as little as $10.

Tiered VIP Rate System and Referrals

Bitunix operates a tiered system for traders. The VIP system classifies users according to their 30-day trading volume or the value of their asset positions on the platform. Users in higher VIP ranks enjoy a lower trading fee.

Bitunix also offers its users referral bonuses, where users who invite their friends to the platform can enjoy up to a 40% rebate on transaction fees once their referrals complete their registration and start trading on the platform.

Customer Support

Bitunix users can access customer support through the support page, which addresses frequently asked questions around deposits and withdrawals, along with spot and futures trading. There is also a chatbot available, where users can ask questions around issues they face on the platform, guaranteeing quick access to live customer officers in under 1 minute.

Community Building

Bitunix organizes weekly live sessions on Telegram for traders to learn and exchange ideas, which are open to anyone from pro traders to beginners. Bitunix also conducts AMA sessions on Twitter to share knowledge and trends around the Web3 space with their community.

Ready to start using the Bitunix exchange? Here’s a user-friendly guide.

Trading on Bitunix

Since Bitunix is a non-compulsory KYC platform, your initial registration qualifies you to start trading on the platform. To register

- Visit the Bitunix platform

- Click Sign up on the homepage to begin your registration

- Enter your details. (You can use your email address or your mobile phone number for your registration)

- Click Sign Up to continue

- Verify your email address using the code sent to your mail to complete your registration.

- You can now deposit crypto on the platform to start trading.

How to Trade Futures on Bitunix

To trade perpetual futures contracts on Bitunix:

- Click Markets from the menu to navigate to the pair catalog

- Click Trade on the pair you wish to trade

- Set your order price and enter the amount you wish to trade in the quantity box

- Click on the leverage selector in the top right corner.

- Slide the selector to your desired leverage level.

- Click your position (short or long) and click Confirm.

- Click Confirm from the pop-up to complete.

You can manage your position from the order tab.

Spot Trading on Bitunix

To trade crypto assets on the spot market;

- Click Markets from the top menu and navigate to the spot trade market.

- Click Trade on your desired asset pair

You can trade using the limit order (set your buy or sale price) or the market order (buy or sell at the presiding market price) - Set your trading parameters and click Buy or Sell to complete.

Trading Fees on Bitunix

Bitunix charges a maximum of 0.1% fee for spot trades (0.08% Maker fee and 0.1% Taker fee). The maximum fee charged for futures trading is 0.06% (0.02% Maker fee and 0.06% Taker fee).

Trading fees differ across tiers. VIP tier 7 pays a maximum of 0.0325% of trade volume for spot markets and 0.03% for futures markets. Users’ VIP tier rises according to their 30 days cumulative trading volume on spot and futures trading markets, or their USDT balance. See a detailed breakdown of trading fees and VIP tiers on the Bitunix exchange.

Fees can also apply to crypto and fiat withdrawals. Withdrawal fees for crypto assets depend on the token and the network used for the withdrawal. You can find the applicable fees for each asset here.

Conclusion

Bitunix is structured to give traders an opportunity to thrive in a market known for its volatility. Users get to enjoy low trading fees in addition to other perks like 24/7 customer support.

For new users, Bitunix offers bonuses of up to 5,000 USDT for deposits made within 72 hours of their registration on the platform. Bitunix will continue to incentivize users through regular promotional programs as the platform continues to grow. Learn more about the Bitunix welcome and futures trading bonus program.

Having said this, always do your own research and understand how the platform manages users’ funds and other aspects that are vital to you as a user. This article is only for informational purposes and should not be taken as financial or investment advice.

Bitunix is available as a mobile application on the Apple Store for iOS users and the Google Play Store for Android users, enabling its users to trade on the go. Bitunix also offers 24/7 automated support for its users.