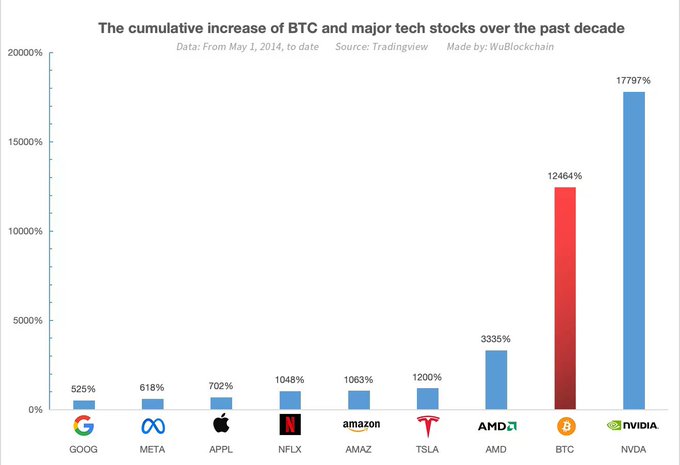

In the last ten years, Bitcoin, the dominant cryptocurrency, has beaten tech giants such as Amazon, Google, and Netflix, despite the volatility in prices, boasting 12,464% growth, as reported by WuBlockchain.

It is now trading at $61,766 per token, 17% below its peak. Nvidia’s stock exceeded Bitcoin’s growth with a 17,797% increase over the past decade, while other top tech investments include AMD, Tesla, and Amazon.

AMD ranked third with a 3,335% price increase, while Tesla followed with a 1,200% increase, and Amazon completed the top five with a 1,063% gain.

The recent Bitcoin halving, reducing block mining rewards, aims to maintain scarcity. While short-term price movements may vary, experts foresee long-term positive impacts.

Peter M. Moricz of DCL.Link noted concerns over mining centralization and emphasized the inevitability of higher Bitcoin prices. He suggested a market correction followed by upward trends due to Bitcoin’s limited supply.

Peter M. Moricz, from DCL.Link, said, “A correction, with some sideway trading, will give a healthy market for the next leg up. BTC scarcity is real – there are only 21 million BTC out there no matter what.”

With growing institutional interest, such as the anticipation of a Bitcoin ETF, Bitcoin’s long-term prospects remain positive, reinforcing its position as a valuable asset in the evolving financial landscape.

Also Read: Block to Invest 10% of Bitcoin Profits into BTC Monthly