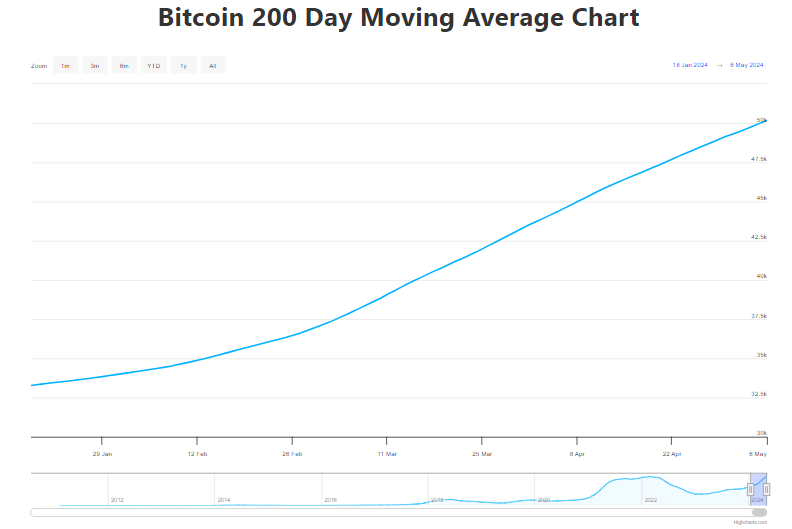

The world’s first cryptocurrency, Bitcoin, has seen its 200-day moving average reach an unprecedented level of $50,178, signaling a bullish outlook for long-term price trends.

This major indicator removes short-term volatility, showing a bullish trend when BTC trades above it, as it currently does. Despite a post-halving dip, Bitcoin’s recovery is evident, as the 200-day moving average crossed $56,800 on April 20.

The 200-day Simple Moving Average (SMA), a measure that takes closing prices over 200 days into account, reduces short-term volatility. The current trading prices above this average level imply a generally bullish trend.

In the WooCharts drawn by the analyst Wily Woo, the 200-week moving average had a record of $34.19K, and this trend is shaping up as a strong upswing for the year. Bitcoin, by now, has been hovering around this level since mid-October.

Having decreased by 100 contracts in the last 50 days, this number is slightly lower than the peak in mid-April. Signs of recovery are noticeable, such as the first inflow of the Grayscale spot Bitcoin ETF on May 3, indicating stronger investor bullishness.

Bitcoin’s 200-day moving average leaping to $50,178 signals a clear bullish long-term trend, supported by technical indicators, recent market developments, and growing investor interest, indicating significant growth opportunities.

Also Read: Bitcoin Bullish Signal? Analyst Points to VWAP Divergence