Fintech firm Block, formerly known as Square, has made a bold move by announcing plans to raise a whopping $1.5 billion through a private placement of senior notes. This comes on the heels of a strong Q1 performance and raised guidance for 2024, sparking questions about the company’s future strategy and potential use of the funds.

Why the Private Placement?

Unlike a public offering, a private placement targets a select group of investors, often large institutions like pension funds and high-net-worth individuals. This suggests Block may be seeking specific strategic partners or investors who believe in its long-term vision.

The company made a statement that the terms of the notes, including interest rates and maturity dates, are up for negotiation with the initial purchasers. Investors permitted to join the round include pension funds, banks, mutual funds, and other high-net-worth individuals.

What’s the Money For?

Block’s decision to raise capital through debt indicates a potential appetite for aggressive expansion. While Jack Dorsey’s established company boasts a strong balance sheet, this move suggests ambitions beyond organic growth. Analysts speculate that the funds might be used for strategic acquisitions or investments in emerging areas within the payments and financial services sectors.

The firm’s early embrace of Bitcoin, with a dedicated 10% of gross profit from Bitcoin products allocated for further purchases, positions the company as a strong advocate for cryptocurrency. It’s unclear whether this is a strategic long-term bet on the cryptocurrency or simply a way to diversify its holdings.

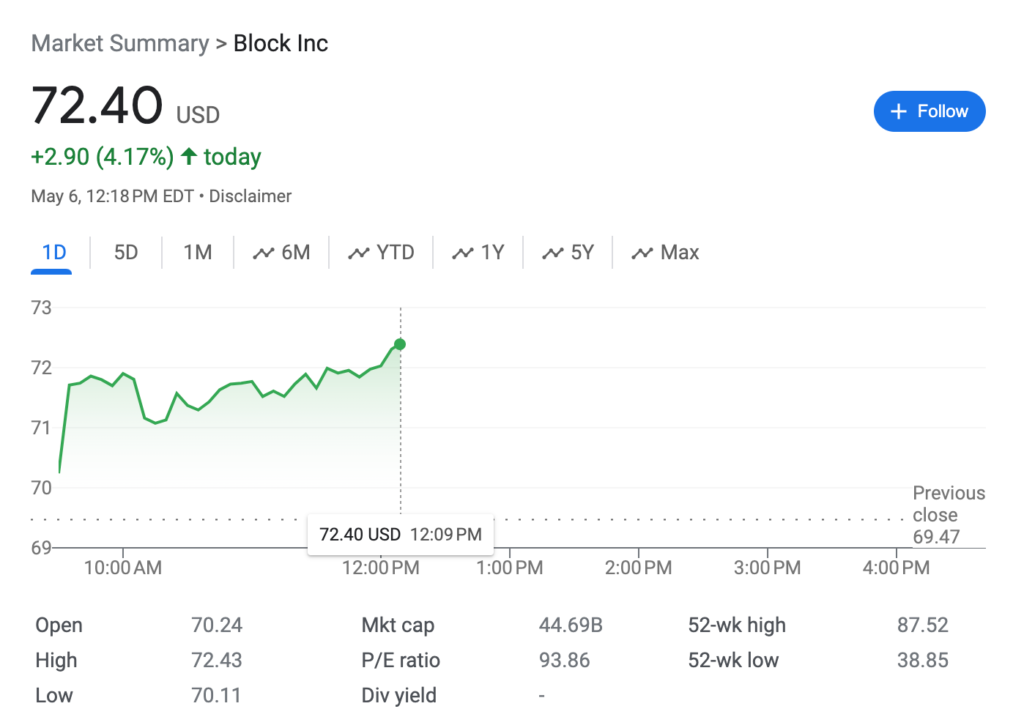

Stock Price Rising

Despite concerns about the debt load, Block’s stock price surged 4% following the announcement. Block share price went up to $72.40 from $70.

Block’s move to raise $1.5 billion through a private placement is a significant development. It signals the company’s ambitious plans for expansion, debt management, and potential acquisitions. While the specific use of the funds remains to be seen, one thing is clear: Block is playing a bold game in the ever-evolving financial landscape.

Also Read: Block to Invest 10% of Bitcoin Profits into BTC Monthly