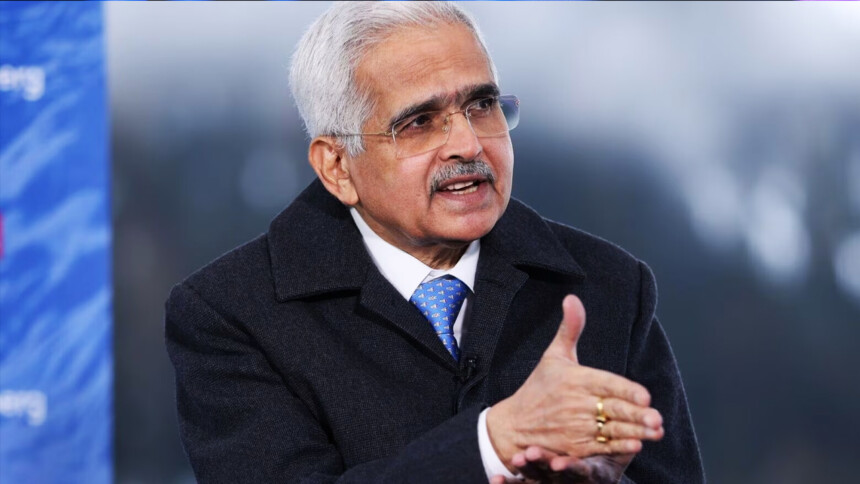

Shaktikanta Das, governor of the Reserve Bank of India (RBI), discloses India’s intentions to create digital money that may be accessed without reliance on the internet.

Das stated on Monday at a Bank for International Settlements event that “working offline is one of the key features of cash. He continues, “We are working on making the CBDC transferable in the off line mode also.”

India pioneers central bank-backed digital currency experimentation amidst global caution. With 1.3 million customers and 300,000 merchants in a pilot, CBDC usage hits 1 million daily. Yet, as per Dad, instant mobile payments remain preferred.

Das stated, “The key objective of the pilots has been a change in consumer behaviour vis-a-vis bank deposits — we need many more transactions to understand its wider economic effects, especially on monetary policy and the banking system.”

Speaking remotely with counterparts from Germany and Italy, namely Joachim Nagel and Fabio Panetta, on a panel moderated by BIS head of research Hyun Song Shin, Governor Shaktikanta Das emphasized that making CBDCs “non-remunerative” and “non-interest bearing” has effectively mitigated any potential risk of bank dis-intermediation.

While CBDCs promise increased transaction efficiency, challenges such as data privacy and cybersecurity persist, hindering full-scale implementation. The RBI’s cautious approach mirrors global sentiment, with only a handful of countries, including Jamaica, the Bahamas, and Nigeria, having fully launched CBDCs to the public.

Also Read: India’s RBI to Introduce Offline E-Rupee Transactions