The former CEO of BitMEX, Arthur Hayes, predicts that ENA could surge to $10, aligning with Bybit’s adoption of USDe as collateral, which includes Bitcoin and Ether trading pairs, impacting market dynamics and adoption.

The integration of USDe into Bybit’s trading infrastructure enhances capital efficiency and enables diverse trading strategies. USDe’s inclusion in spot trading pairs with major cryptocurrencies expands its utility.

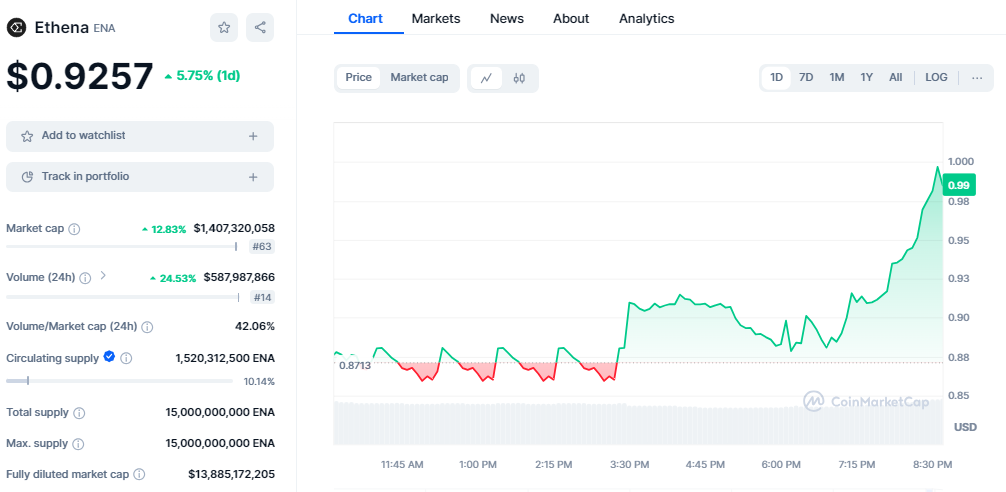

ENA’s price surged post-announcement, hitting $0.9968 before settling at $0.9257, with a 24-hour trading volume of $587,987,866 as per CoinMarketCap. Ethena’s market cap is now $1,407,320,058, highlighting strong investor interest in ENA’s growth prospects.

Ethena Labs’ CEO Guy Young is optimistic, viewing this as a vital step for USDe’s utility and market presence. This move challenges stablecoin market dominance, attracting traders to a customized product.

Despite recent market weakness, USDe’s integration with Bybit signals growth potential, with partnerships across major exchanges facilitating adoption and collaboration.

In essence, Bybit’s embrace of USDe signifies a significant milestone for Ethena, bolstering its market position and paving the way for broader adoption within the crypto community.

Also Read: BitMEX Warns of 47% Bitcoin Mining Hashrate Centralization