The White House has strongly opposed H.J. Res. 109, proposed legislation seeking to nullify SEC Staff Accounting Bulletin (SAB) No. 121. The bulletin places stringent requirements on financial firms that handle digital assets, which the resolution aims to overturn.

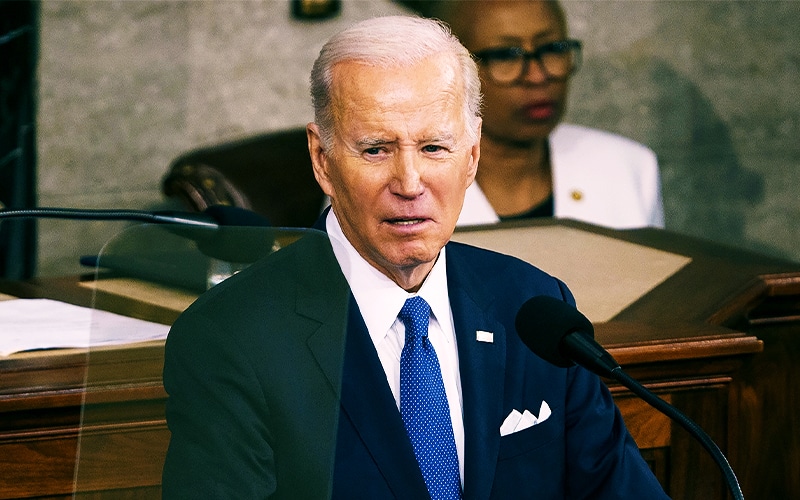

However, the office of the president contends that such a step would result in chaos in the ability of the Securities and Exchange Commission to protect the investors’ interests and provide stability to the financial system. Should this resolution reach President Joe Biden’s desk, he is ready to veto it.

Congressional Support for Nullifying SAB 121

Prominent members of Congress have favored H. J. Res. 109, emphasizing issues with the regulatory framework that the SEC has implemented. Patrick McHenry, the chairman of the financial services committee in the House of Representatives, thought that SAB 121 is an example of regulatory overreach that puts an excessive financial load on banks.

He emphasized that the bulletin forces financial institutions to absorb costly capital and liquidity requirements when holding digital assets, a departure from standard banking practices.

Congressman French Hill echoed similar concerns, arguing that holding reserves against custodial assets deviate from the norms of financial services. He views the Biden administration’s approach as fundamentally flawed and supports the resolution to nullify SAB 121.

Industry Perspective on Regulatory Restrictions

Advocacy groups like the Chamber of Digital Commerce are equally critical of the administration’s policy in the digital asset space. The Chamber’s Chief Policy Officer, Cody Carbone, condemned the SEC’s SAB 121 for effectively preventing reputable custodians from managing digital assets.

Congressmen Mike Flood and Wiley Nickel, who co-wrote an op-ed criticizing the SEC’s bulletin, raised concerns that limiting custodian options could heighten concentration risks.

As the debate around H.J. Res. 109 intensifies, the divide between the Biden administration’s regulatory priorities and the crypto industry’s aspirations remains prominent.