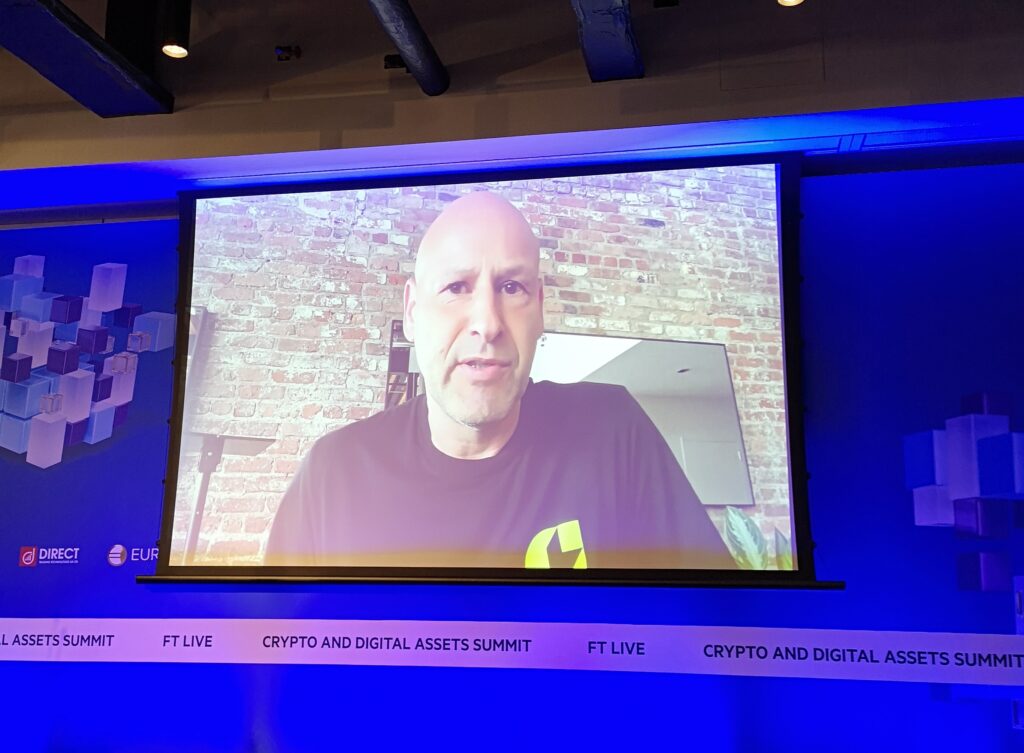

Joseph Lubin, one of the co-founders of Ethereum and CEO of Consensys, slammed the U. S. Securities and Exchange Commission (SEC) for its method of cryptocurrency regulation. During the FT Live’s Crypto and Digital Assets summit in London, Lubin stated that SEC is doing strategic enforcement rather than open discourse.

This statement comes after Consensys’s decision to sue the SEC after being served a Wells notice, signaling potential enforcement action.

SEC’s Security Classification of Ether

Lubin noticed that the SEC has apparently reclassified Ether as a security without informing the stakeholders. Lubin argues that this development looks like a revelation because it is designed to create fear, uncertainty, and doubt within the cryptocurrency sector.

He stressed that the Commodity Futures Trading Commission had earlier classified Ether as a commodity, pointing out the confusion in the regulatory positions.

Lubin also hinted that the timing of the SEC’s actions could be associated with the forthcoming ruling on Ether spot exchange-traded funds (ETFs) approval. He suggested that the recent enforcement actions of the SEC might be a way to legitimize the possible rejection of these ETFs.

Additionally, Lubin assumed that the SEC could be worried about excess capital in the cryptocurrency environment, which could pose a threat to traditional financial institutions.

Lubin emphasized the significance of the suit with the SEC, saying that calling wallets such as MetaMask broker-dealers could have broad implications for the technology industry in the US.

Read Also: Ripple vs. SEC: Judge May Toss SEC’s $2 Billion Fine