Institutional investors are in the process of buying Bitcoin ETFs due to the cryptocurrency market’s recovery.

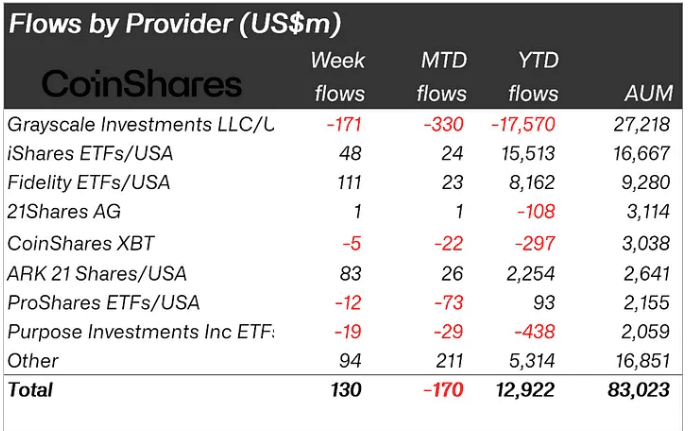

After five weeks of outflows, the digital asset investment products started to attract inflows again with a total amount of $130 million that was recorded during the week ending on May 6. The Bitcoin investment funds alone got $144 million of inflows.

Despite a significant surge in capital inflows, trading volumes in investment products declined., the average weekly trading volume stood at $17 billion in April, However, it dropped to $8 billion by the week ending May 10.

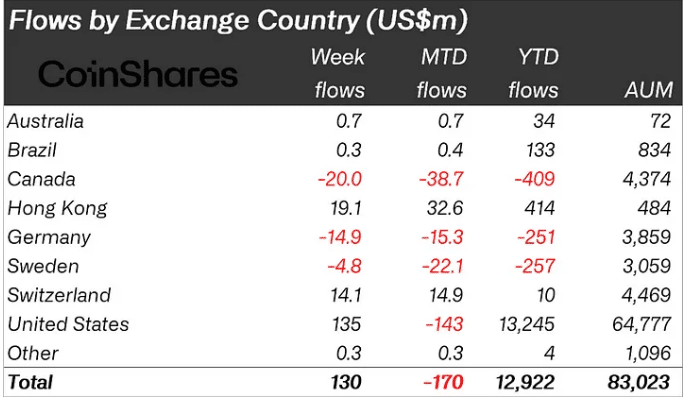

Regionally, the United States was the biggest source of flows with $135 million, and Switzerland was second, with $14 million.

Interestingly, the State of Wisconsin Investment Board stated that it has Bitcoin investment in the spot and has invested in shares of BlackRock’s iShares Bitcoin Trust and Grayscale’s Bitcoin Trust in the first quarter of the year.