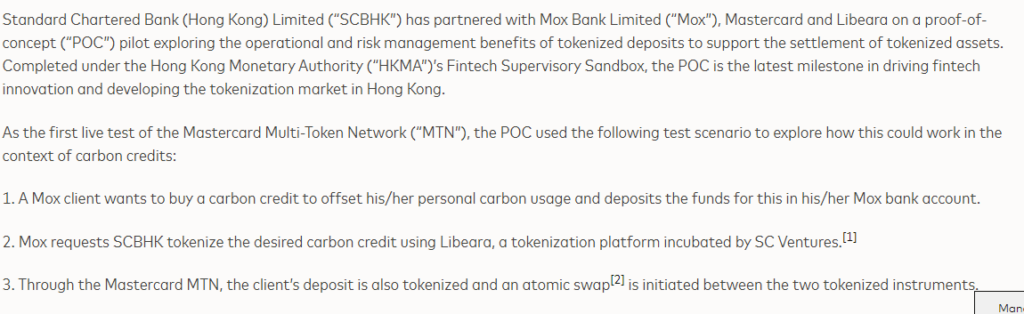

Standard Chartered Hong Kong (SCBHK) and Mastercard have successfully launched the first live test of tokenized deposits in Hong Kong’s fintech sandbox. This test, held through Mox Bank and Libeara partnership, denotes an important milestone in terms of trying blockchain technology greater role in banking operations and fund governance.

An online demonstration was provided where a Mox bank client bought a carbon credit and it then was tokenized by SCBHK running the carbon tokenization platform Libeara. Via Mastercard’s Multi-Token Network (MTN), a homemade swap between the tokenized fulfillment and the carbon credit getting conserved and compliantly went to the client’s wallet.

Saving here implies the technical feasibility of sending or receiving the certified coin deposit, which absolved the transaction process, transparency, and security of financial industry standards.

The achievement of this test is voted as the HKMA’s surfacing practice. Band explores more digital forms of central bank digital currency (CBDCs) and deposits tokenized in Hong Kong, following its eagerness to catch up with the flow of digital assets and blockchain.

Also read: Mastercard Teams Up With Major US Banks for Tokenized Settlements