President Joe Biden has decided not to veto the Financial Innovation and Technology for the 21st Century Act, despite opposition. This decision reflects an openness to foster a collaborative legislative effort on cryptocurrency regulation.

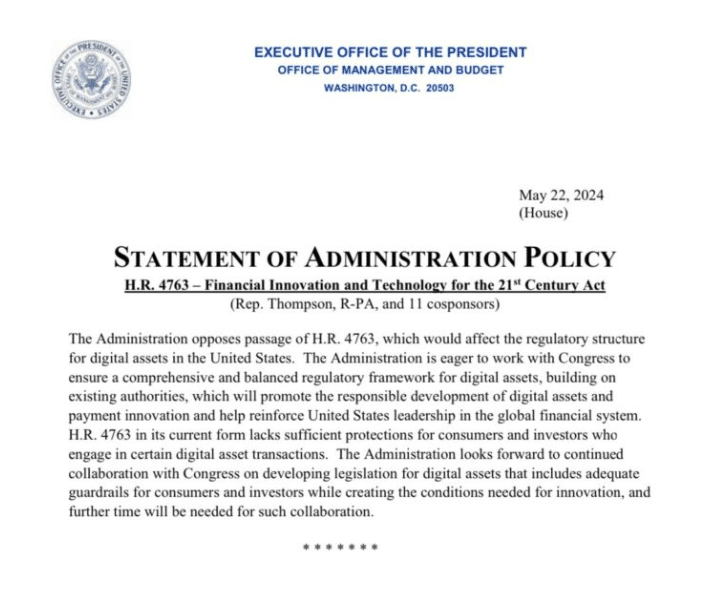

The administration has voiced its concerns regarding the bill’s lack of sufficient protections for investors engaging in digital asset transactions.

Moreover, the statement from the administration emphasizes the need for a balanced regulatory framework that supports the responsible development of digital assets. The bill, set for a vote in the House later today, proposes changes to how securities issuers comply with federal laws.

Legislative Responses and Future Directions

After the administration’s statement, the SEC Chair, Gary Gensler, issued a dissenting opinion, pointing to some of the risks to the regulator’s oversight of capital markets. These concerns echo the discussion that is still happening today about the right amount of regulation need for the emerging crypto market.

Moreover, the White House has stated that it will pursue cooperation with Congress to design legislation that will provide sufficient protection to the consumers and investors.

This approach suggests a strategic patience, allowing more time for developing a comprehensive legislative framework for digital assets. The ongoing discussions and proposed legislative efforts indicate a period of transformation as stakeholders strive to balance innovation with investor protection.

Also read: Donald J. Trump Presidential Campaign Now Accepting Crypto