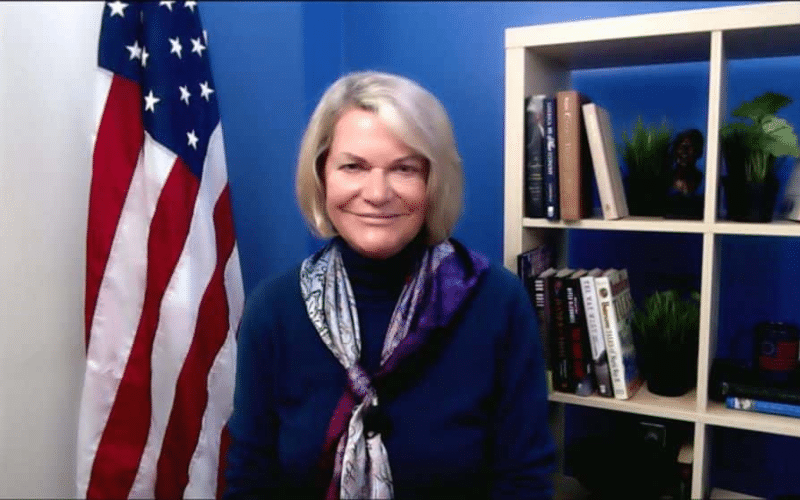

The U.S. Securities and Exchange Commission’s (SEC) approval of applications for spot Ether exchange-traded funds (ETFs) has sent ripples through the cryptocurrency industry. Senator Cynthia Lumis (R-WY) took to Twitter today to leverage the US SEC approval of a spot exchange-traded fund (ETF) for Ether to urge Congress to establish a clear regulatory framework for the industry.

Lumis sees this as a sign of growing acceptance for cryptocurrency as a legitimate asset class. However, her tweet also emphasizes the need for Congressional action to establish a regulatory framework for the industry.

The SEC’s approval, announced yesterday, paves the way for the launch of several Ether-based ETFs on major US exchanges. The approval comes after months of speculation and follows the SEC’s decision in January to allow Bitcoin spot ETFs.

Analysts believe this could increase investor access and liquidity in the Ethereum market, particularly for institutional investors seeking regulated exposure to the cryptocurrency. However, some experts caution that the path to trading these ETFs could take several weeks as the SEC reviews individual applications. Additionally, the recent $100 price drop in Ethereum, from $3800 to $3700 despite the positive news, highlights the crypto market’s volatility.

Such concerns around market volatility and consumer protection remain, prompting Lumis’ call for Congressional action. It is still unclear when the Ether ETFs will begin trading, as further approvals from the SEC are required for individual applications from asset managers.