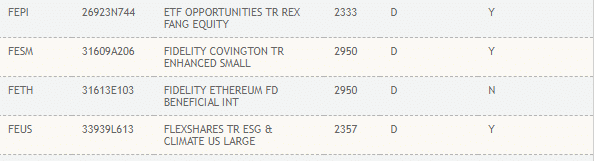

The wait for a U.S. spot Ethereum ETF continues, but Fidelity Investments’ offering has taken a step forward. The Depository Trust and Clearing Corporation (DTCC) has included Fidelity’s Ethereum FD Beneficial INT fund (ticker symbol FETH) on its list of ETFs.

While the inclusion on the DTCC list is a positive development, it doesn’t signal an immediate launch. The DTCC clarifies that the “N” mark under the create/redeem column signifies FETH as a “pre-launch” ETF and won’t be tradeable until it receives all necessary approvals.

The DTCC’s inclusion of FETH follows similar actions for proposed spot ether ETFs from other companies like VanEck, Franklin Templeton, and BlackRock. However, the DTCC has previously emphasized that this is standard procedure and doesn’t guarantee regulatory approval from the Securities and Exchange Commission (SEC).

Last week, the SEC provided a key green light by approving the 19b-4 forms for eight spot ether ETF proposals, including Fidelity’s. However, the final hurdle remains – SEC approval of the S-1 registration statements. Both Fidelity and BlackRock recently filed amended S-1 forms for their respective ETFs.

BlackRock’s spot bitcoin ETF, which launched recently, has become the largest ETF of its kind. This success story adds fuel to the expectations surrounding potential spot ether ETFs.

While the inclusion on the DTCC list marks progress for Fidelity’s spot ethereum ETF, investors should be aware that regulatory approval from the SEC is still required before trading can begin.