The Ether options market is abuzz with bullish activity as traders bet on potential price surges, with a notable focus on the substantial open interest in $5,000 call options expiring at the end of June.

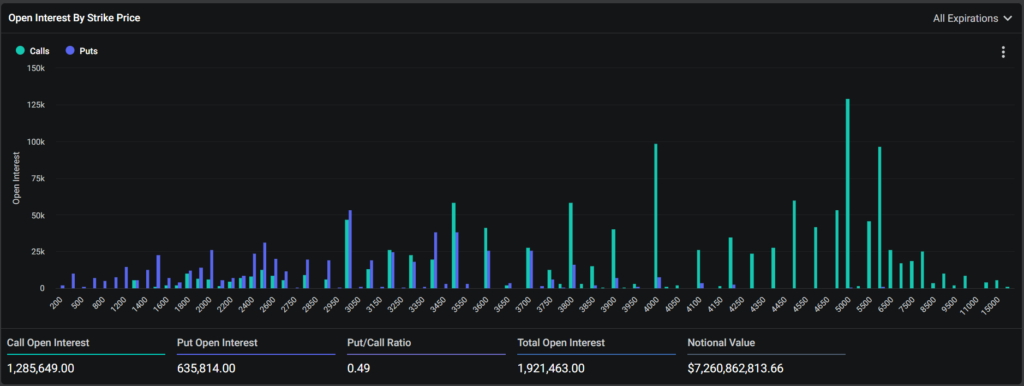

Data from the Deribit derivatives exchange, which indicate that calls with a $5,000 strike price have the highest concentration of open interest in ether options, corroborate this result.

Co-founder Rachel Lin and other analysts at SynFutures note this trend, which is corroborated by data from Deribit that shows a concentration of call options at the $5,000 strike.

QCP Capital’s additional research clarifies traders’ tactics and shows that Ether has an optimistic outlook for the upcoming month. In a calculated move, traders are purchasing $4,000 strike price call options and selling $5,000 strike price call options, both of which expire at the end of June 2024.

Analysts at QCP Capital stated, “The desk observes bullishness in ether, with sizeable buyers of $4,000 to $5,000 ether call spreads for end-June 2024.”

Additionally, the put-call ratio, which favors call options more than puts, supports the general bullish mood. Lin observes that 35% of Ether’s open interest is in puts and 65% is in calls, further endorsed by Deribit’s 0.56 put-call ratio for the end-of-June expiry.

Even if the spot market is consolidating, the options market has a bullish forecast for June, as stated by Lin. “If the current trend persists, we may be on the brink of another bullish rally in the near future.”

The U.S. Securities and Exchange Commission approved ether spot ETFs on May 23, but unlike bitcoin ETFs, they may go live after some time. QCP Capital analysts emphasize the need for clarity on S-1 approvals before forecasting a potential ether price breakout.

As per the data of CoinMarketCap, the price of ether has been increased by 0.2%, and is valued at $3,768.

Also Read: Ethereum Co-Founder Vitalik Buterin Donates to Legal Defense of Tornado Cash Developers