Keith Gill, known as “Roaring Kitty,” has reportedly shared his GameStop (GME) holdings to a market value of $300 million, stirring allegations of market manipulation from Citron Research. This controversy surfaced shortly after Citron disclosed its short position in GME.

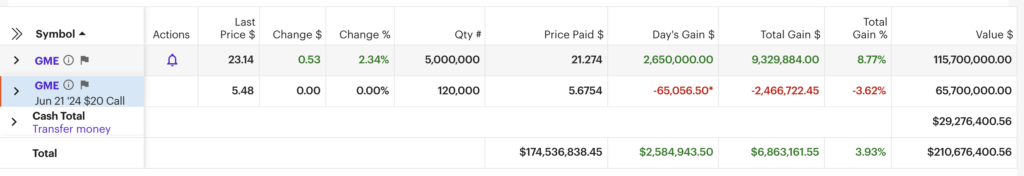

Gills revealed in a screenshot that he has purchased over five million GME shares for $115.7 million and placed call options for $65.7 million, betting GME to stay north of $20

Citron, a vocal critic and prominent short seller of GameStop shares claims Gill’s actions align more with market manipulation than standard investment strategies. Citron highlighted Gill’s GME position, including a substantial amount in near-term options, as potentially manipulative, given his influence and large following on social media platforms.

They argue that his financial maneuvers lack a robust investment thesis, especially considering the extraordinary 2,000% increase in GME stock price from his initial investment period nearly four years ago.

Backlash and Speculation

Retail investors, particularly active on forums and social networks, defended Gill’s investment strategy, citing his consistent purchasing of in-the-money call options and transparency in his trading moves.

Moreover, Citron’s recent allegation that an undisclosed larger entity might financially back Gill has added fuel to the ongoing discourse regarding the legitimacy and transparency of market influencers.

Currently, the stock of GameStop has appreciated by 10.6% on the daily chart and 65% in the last month. This increase comes at the same time as Gill’s latest financial filings, which showed that he could become the first billionaire in GameStop if the stock price rises.

The situation highlights the blurred boundary between influential investing and market manipulation, especially as digital platforms increasingly magnify the impact of individual investors on market dynamics.

Also Read: E-Trade Eyes Removing Roaring Kitty Amid GME Frenzy: WSJ