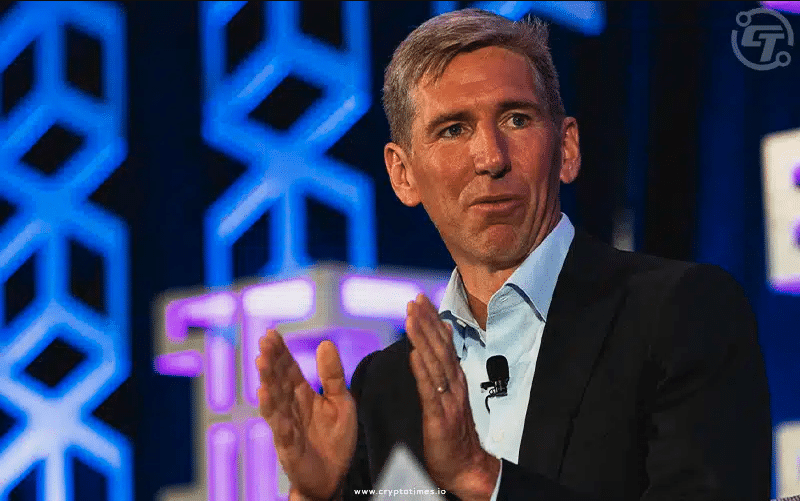

Investment firm Bitwise’s CIO, Matt Hougan, foresees the crypto sector benefiting as the United States approaches clear guidelines, poised to tap into the $20 trillion financial advisory market when legal uncertainties are resolved.

Hougan has stated that regulatory uncertainty has been the main factor that has limited the growth of financial advisors’ engagement with crypto assets in the last five years. Still, it also points out that there is a change in the legal framework that may result in increased adoption in the sphere of financial advisory services.

Hougan envisions a future where a substantial portion of the $20 trillion in financial advisory assets will transition to crypto once regulators grant full access, drawing parallels to BlackRock’s entry into the market and anticipating further market expansion.

Recent progress includes Democrats joining forces to repeal Staff Accounting Bulletin 121, the House approving the Financial Innovation and Technology for the 21st Century Act (FIT21) as a win for the crypto industry, and the Securities and Exchange Commission’s approval of spot Ether ETFs on May 23, signaling positivity.

Even though Biden has recently vetoed the SAB 121 repeal, Hougan still sees great potential in the future of cryptocurrencies. He also notes that there are still issues to be solved, for example, the fate of the FIT21 in the Senate and the imminent release of spot Ether ETFs, but on balance, the trend is up.

Hougan highlights the considerable growth potential in the crypto market, noting a lack of awareness among some individuals about its existence and potential. He believes that heightened awareness of crypto-related political developments will propel the market to new heights.

Although the change in regulation has not been fully realized, Hougan remains positive about the future of the crypto market. He expects tangible actions in Washington and is confident that the market will continue to expand and create more opportunities for participants in the cryptosphere.

Also Read: Trump Possibly Knew About Ether ETF Approvals, Bitwise Executive Claims