MicroStrategy, a U.S. based business intelligence firm, saw its stock price going nearly triple in six months, that has led to a rise in confidence of hedge funds for its decline to wane, with short-sellers amassing up to $6.9 billion in positions.

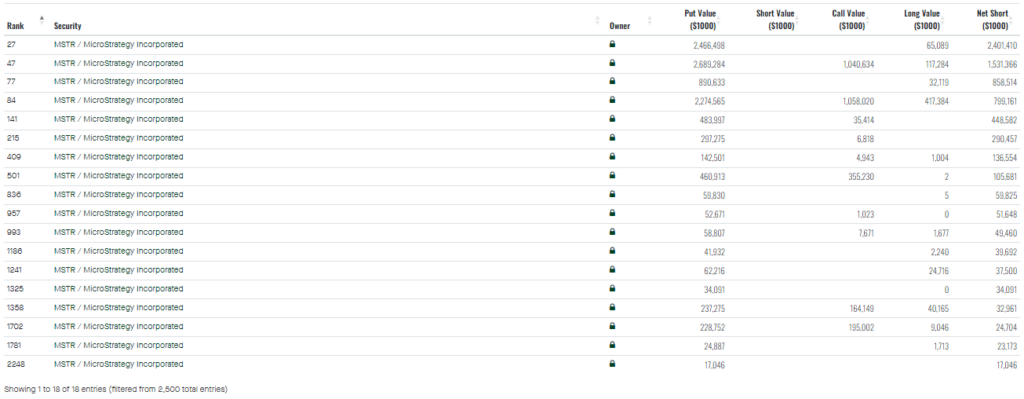

By June 6, MicroStrategy had 18 short positions listed on Fintel’s “The Big Shorts” list, and the largest position was valued at about $2.4 billion and ranked 27th of all institutional investors with the highest net short position.

In the U.S., the highest net short position is held by the SPDR S&P 500 Trust ETF, valued at $114.6 billion, which is far lower than the peak net short position of $3.60 billion recorded for Amazon stock.

Short seller confidence has significantly decreased as MicroStrategy’s short-interest ratio dropped by nearly 50% in the last six months, from 3.1 days to 1.5 days, despite some firms taking short positions against the company.

This ratio is useful for traders to determine the days of a short squeeze and how many days short sellers need to cover their positions. Conversely, a lower number suggests that there is lower demand from short sellers in the market.

Google Finance data indicate that MicroStrategy’s stock has been on a rally since December 2023 with the price starting from $570 and has tripled to $1,656.

This increase occurred just a few weeks after Kerrisdale Capital, a firm that had short positions against MicroStrategy, put more pressure on the company’s shares after the launch of spot Bitcoin ETFs earlier this year.

In response to the approval of several spot Bitcoin ETFs, Kerrisdale stated that there are no longer any valid reasons for investors to swap MicroStrategy shares for Bitcoin exposure.

MicroStrategy’s robust stock performance showcases its resilience against short-sellers and competitors, reflecting its ability to adapt and grow in dynamic market environments, generating ongoing interest from investors and analysts.

Also Read: Microstrategy’s Saylor To Pay $40M to Settle DC Tax Lawsuit