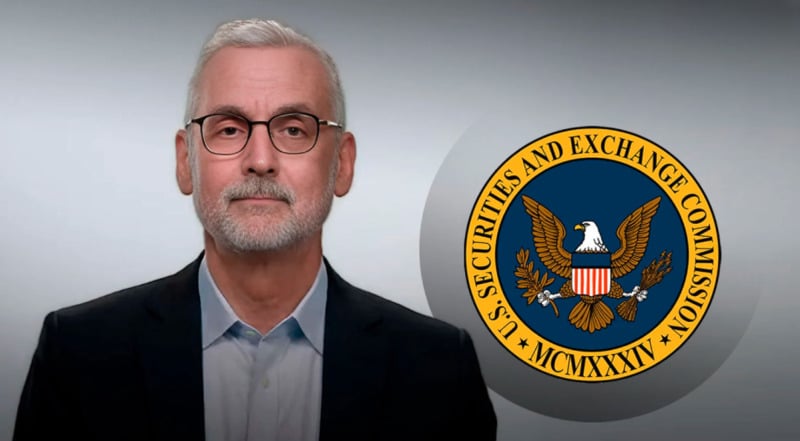

Chief Legal Officer of Ripple, Stuart Alderoty, recently expressed his concerns over alleged “waste” of taxpayers’ money in the United States by the federal agency Securities and Exchange Commission (SEC) for “overreaching” on its enforcement actions.

Taking to his X account, Alderoty criticized the Gensler-led SEC, questioning the amount of tax dollars wasted in attempts to expand the SEC’s authority beyond legal norms.

The SEC has been under pressure from the different stakeholders in the cryptocurrency industry concerning its regulatory stance. Alderoty’s comments contribute to the list of complaints against Gensler’s leadership at the SEC.

Alderoty also singled out a judgment made by the Fifth Circuit on June 5, where it dismissed an SEC request for more detailed disclosures from private fund investors. If the ruling was in the favor of the SEC, it could have affected many markets such as artificial intelligence and cryptocurrencies.

This has been compounded by the recent call by Ripple Labs Inc. CEO Brad Garlinghouse who demanded that Gensler be fired, a call that saw the trending of the “Fire Gensler” hashtag on social media platforms, while others dismissed the call as undemocratic.

U.S. lawmaker Tom Emmer criticized Gensler’s regulation of Ethereum (ETH) and questioned the SEC about Ethereum’s security status, expressing concerns over potential harm to investors and market integrity, impacting the U.S.’ global economic standing.

At the Consensus 24 Conference, Emmer criticized Gensler for overregulation hampering capital investment and innovation, prompting Gensler to clarify that the approval of a spot Ethereum ETF was not imminent, indicating uncertainty around the decision.

The ongoing debate shows the discord between the regulators, industry participants, and lawmakers concerning the regulation of cryptocurrencies and the SEC’s role in the regulation of these markets.

Also Read: SEC Announces Shutting Down of Salt Lake Regional Office