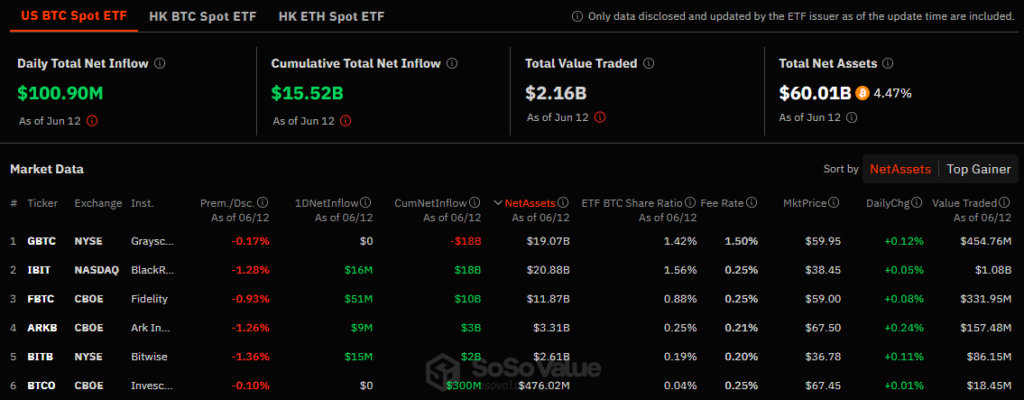

A major shake-up in the U. S. spot Bitcoin exchange-traded funds (ETFs) saw a total of $100.9 million in net inflows. This reversal comes after previous net redemptions and also ends a record 19-day straight investment spree.

Fidelity’s FBTC led with $51 million in inflows, followed by BlackRock’s IBIT at $16 million, Bitwise’s BITB, VanEck’s HODL at $15 million and $12 million, and Ark Invest’s ARKB with a $9 million increase in net assets, according to SosoValue data.

Nevertheless, Grayscale’s GBTC, WisdomTree, and Invesco had no new money. Altogether, the 11 Bitcoin ETFs have collected a total of $15.52 billion in net inflows since the launch.

The surge in ETF investments on Wednesday coincided with the U.S. Labor Department reporting no change in the consumer price index for May, potentially signaling a slowdown in the inflation rate.

Despite the positive economic indicator, the Federal Open Market Committee has decided to maintain the current interest rate of 5.25% to 5.50%, with the Federal Reserve anticipating only one rate cut in 2024 and remaining cautious about the settled deflationary process.

These developments highlight the optimism in Bitcoin ETFs especially given signs of a possible deceleration in inflation rates. The constant demand for these funds demonstrates the market’s favorable attitude towards Bitcoin as a valuable asset.

Also Read: Institutional Cash-and-Carry Boosts U.S. Bitcoin ETFs, Says Glassnode