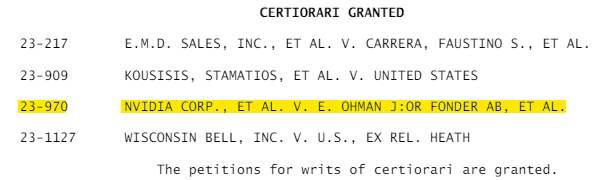

The US Supreme Court has agreed to review a case involving Nvidia Corp’s crypto-mining revenue, potentially impacting laws governing securities fraud suits by shareholders.

A shareholders’ class-action lawsuit alleges that Nvidia and CEO Mrs. Jensen Huang made false statements regarding the significance of revenue from cryptocurrency-related sales in 2017 and 2018.

The lawsuit alleges that Nvidia failed to disclose the proportion of its sales from crypto mining, concealing the impact of this activity on the company’s business from shareholders and stakeholders.

While a district court had earlier entered a 2021 order of dismissal, the 9th Circuit Court of Appeals later reversed that decision and remanded the case for further proceedings, observing that there are plausible allegations of Nvidia engaging in the knowing or reckless making of false or misleading statements.

The company has sought a Supreme Court hearing, citing concerns about potential abusive and speculative litigation, following a prior investigation in 2022 where it paid $5.5 million for inadequate disclosure regarding the impact of crypto mining on its gaming division, which did not halt ongoing shareholder legal action.

This is especially the case given that the Supreme Court has agreed to hear Nvidia’s case at a time when shareholders have been charging various organizations to court for securities law violations.

The second case is the Meta Platforms Inc. shareholders’ case, where they claim that the company has defrauded investors on data exploitation issues, which will also be addressed in the Supreme Court.

US regulators, including the Federal Trade Commission (FTC) and the Department of Justice (DOJ), are investigating Nvidia, Microsoft, and OpenAI for potential anti-trust violations in AI markets regarding market power and competitiveness.

Also Read: NVIDIA Launch Nemotron-4 340B Open Models for LLM Training