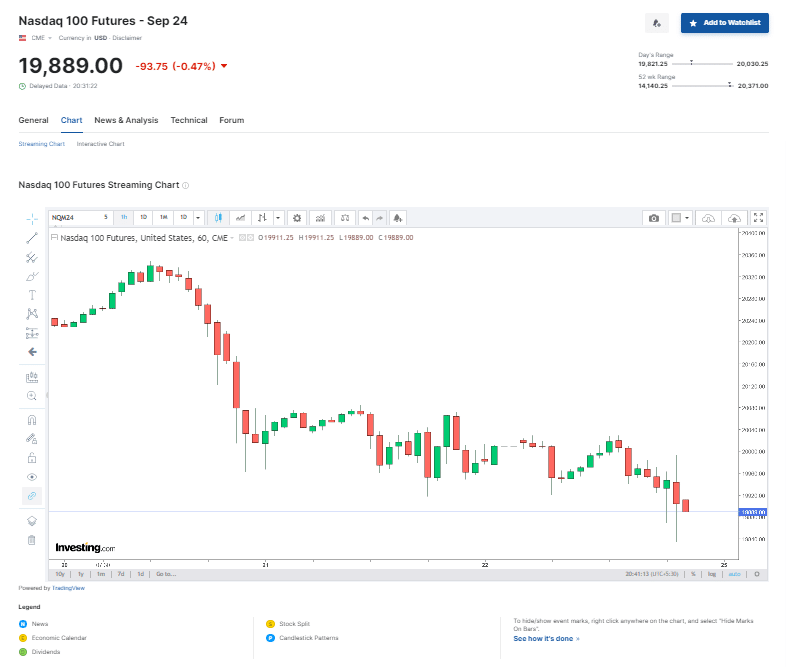

Nasdaq 100 futures fell on Monday as Nvidia Corp. faced its third consecutive day of losses, as investors soured on tech’s exorbitant valuation.

Nasdaq 100 contracts dipped 0.4%, while S&P 500 futures stayed steady. Nvidia’s shares dropped 3%, further lowering its market value below Apple Inc. and Microsoft Corp.

European markets experienced major movements, with France’s Eurofins Scientific SE falling 20% following a bearish report from Carson Block’s Muddy Waters Research.

The Stoxx 600 Index climbed 0.5%, powered by car shares, on news that China and the EU had begun discussing tariffs for electric vehicle imports. Shein, an online fashion store in the United Kingdom, filed a private application for a London listing.

Political risks are mounting as France’s parliamentary elections on Sunday and polls show gains for the far-right National Rally. The first presidential debate in the United States will take place on Tuesday, featuring Joe Biden and Republican candidate Donald Trump.

Despite this, global stocks are buoyed by prospects of economic expansion. The US core PCE measurement on Friday is expected to indicate lowering inflation, potentially resulting in a September interest rate drop. Currently, markets expect a 65% chance of a rate drop.

A strategist at MUFG Bank Ltd., Lee Hardman, noted, “The expectation is we will see confirmation that inflation has slowed and that’s a development the Fed should welcome. If we get more soft inflation prints, they could well signal over the summer they will cut rates in September.”

The Bloomberg dollar index fell by 0.2% following a five-week surge. The yen moved sharply around the 160 mark after Vice Finance Minister Masato Kanda stated that authorities are prepared to intervene to support it 24 hours a day if necessary.

Covestro AG, a German chemicals company, surged more than 7% amid talks with Abu Dhabi National Oil Co. for a €12 billion acquisition. Bitcoin’s losses continued, falling 3% to approximately $61,200, weighed down by withdrawals from US ETFs and concerns about the Fed’s ability to decrease interest rates.

Also Read: Nvidia’s Market Value Soars as Analyst Predicts $5 Trillion Cap