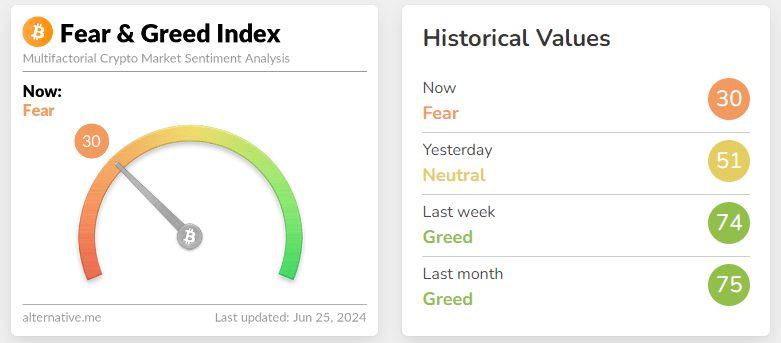

The Crypto Fear and Greed Index, depicting prevailing sentiment in the Bitcoin and overall cryptocurrency market, is currently at its lowest in the last 18 months.

On June 25, the index fell by 21 points to below 30, entering the “Fear” zone for the first time since January 11, 2023, when Bitcoin was at $17,200 after the FTX crypto exchange’s breakdown.

This is one of the largest single-day declines observed over the past few years. A week ago it was at 74, which can be considered as being in the “Greed” zone. Bitcoin dropped to $59,471, its lowest in seven weeks on June 24.

Investors have shown negative sentiment, withdrawing over $1 billion from spot Bitcoin ETFs in the last 10 trading sessions, amid concerns about Mt. Gox’s potential $9 billion Bitcoin repayment, Japan’s plan to pay creditors in Bitcoin, and Germany’s Bitcoin sell-off.

A Galaxy Digital executive believes the market may be overreacting to the Mt. Gox incident. At the same time, a falling network hashrate has forced Bitcoin miners to sell more Bitcoins than usual, weakening sentiment further.

The Crypto Fear and Greed Index factors in market volatility (25%), trading volume (25%), Bitcoin dominance (10%), and trends (10%), with surveys (15%) previously included but currently not measured, and it has remained mostly bearish since reaching 90 “Extreme Greed” on March 5th when Bitcoin surpassed its previous high of $69,000 from November last year.

The recent Crypto Fear and Greed Index, which has been relatively low, suggests the increased caution observed in the cryptocurrency market, based on multiple negative occurrences and responses.

Also Read: Bitcoin Plunges Below $61K Amid Massive Liquidations