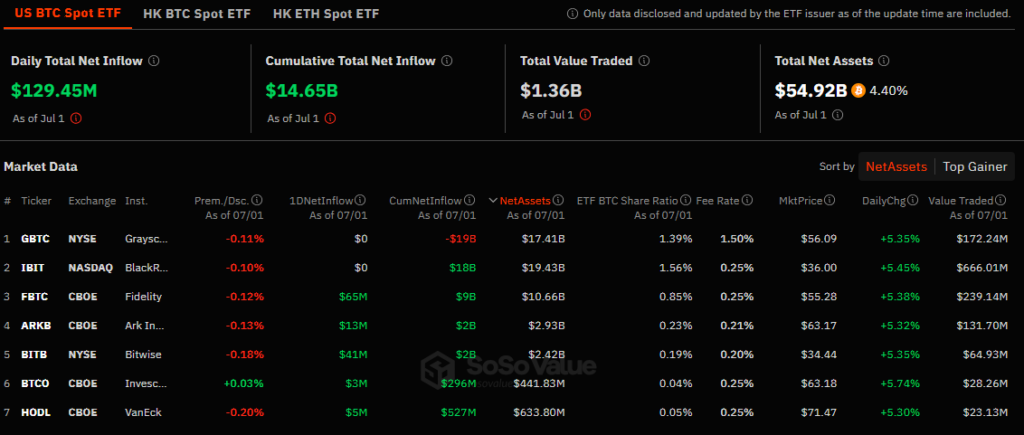

On Monday, U.S. spot bitcoin ETFs saw $129.45 million in net inflows, marking the fifth consecutive day of positive flows and the highest intake since June 7.

According to SosoValue data, leading the charge was Fidelity’s FBTC, attracting $65 million in net inflows, followed closely by Bitwise’s BITB with $41 million. Ark Invest and 21Shares’ ARKB also saw significant inflows, totaling $13 million.

In comparison, Invesco, Galaxy Digital, VanEck, and Franklin Templeton recorded more modest inflows of approximately $5 million or less. In contrast, BlackRock’s IBIT and Grayscale’s GBTC, the largest ETFs by net asset value, reported no net flows on Monday.

The 11 bitcoin ETFs collectively traded about $1.36 billion on Monday, reflecting robust investor activity, while bitcoin’s price dipped 0.3% to settle at $63,094 on The Block’s bitcoin price page, recovering from lows under $60,000 last week but staying below early June highs of over $71,000.

Looking ahead, analysts at QCP Capital noted a positive seasonal trend historically observed for both bitcoin and ether in July. Coinbase analysts echoed this sentiment, reinforcing expectations of favorable market performance during the month.

Substantial ETF inflows and stable price movements indicate ongoing investor confidence in bitcoin amid recent volatility, with the trajectory of these ETFs and bitcoin’s price pivotal in shaping broader market sentiment as regulatory clarity evolves and market conditions adjust.

The ongoing strong inflows into U.S. spot bitcoin ETFs reflect continued investor interest despite recent price fluctuations. As July progresses, market participants will likely keep a close watch on these ETFs and broader cryptocurrency market movements.

Also Read: US Spot Bitcoin ETFs Witness $226M Net Outflow on June 13