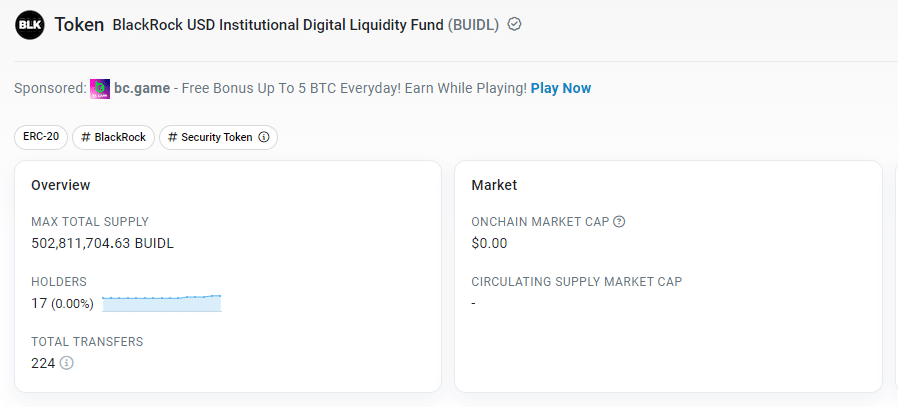

The world’s largest asset manager, BlackRock’s BUIDL fund reaches a $500 million market cap, holding $502.8 million in tokenized treasuries since its launch less than four months ago, as per Etherscan.

The fund’s rapid growth was bolstered by a recent purchase from real-world asset tokenization firm Ondo Finance, which uses BUIDL as a backing asset for its OUSG token.

BUIDL surpassed the Franklin OnChain U.S. Government Money Fund (BENJI) in late April to become the world’s largest tokenized treasury fund, a position it has maintained since its launch on March 15.

BUIDL maintains a stable price pegged 1:1 with the U.S. dollar and distributes daily accrued dividends directly to investors on a monthly basis through its partnership with the real-world asset tokenization platform Securitize.

Ondo Finance holds the largest share of BUIDL at $173.7 million, followed by stablecoin issuer Mountain Protocol, which also holds BUIDL to back its permissionless yield-bearing stablecoin, USDM.

According to data from Dune Analytics, there is now a total of $1.67 billion worth of tokenized treasury funds onchain, with Ethereum leading the tokenization blockchain market with over 75% share, followed by Stellar at 23.9%.

BlackRock CEO Larry Fink has previously highlighted the potential of blockchain tokenization to enhance efficiency in capital markets. Boston Consulting Group estimates that the blockchain tokenization market could reach $16 trillion by 2030, encompassing not just U.S. Treasurys but also stocks, real estate, and various other assets.

While real-world asset transactions peaked in April 2024, recent data from Dune Analytics shows a decline in transaction volume since then. WisdomTree and several blockchain-native firms like Ondo Finance, Backed Finance, Matrixdock, Maple Finance, and Swarm are actively involved in tokenizing real-world assets.

BlackRock’s BUIDL tokenized treasury fund’s rapid ascent to a $500 million market cap underscores growing investor interest in blockchain-based asset tokenization, signaling a potential paradigm shift in global capital markets.

Also Read: BlackRock Acquires Preqin for $3.2B to Index Private Markets