PayPal’s PYUSD stablecoin has seen its supply surge to over half a billion tokens. This significant increase marks a milestone for the U.S. dollar-pegged currency, launched in August 2023 through a partnership with Paxos.

As of July 2024, the growth follows its expansion to the Solana network in May, making it one of the top ten stablecoin issuers globally.

Expansion and Market Impact

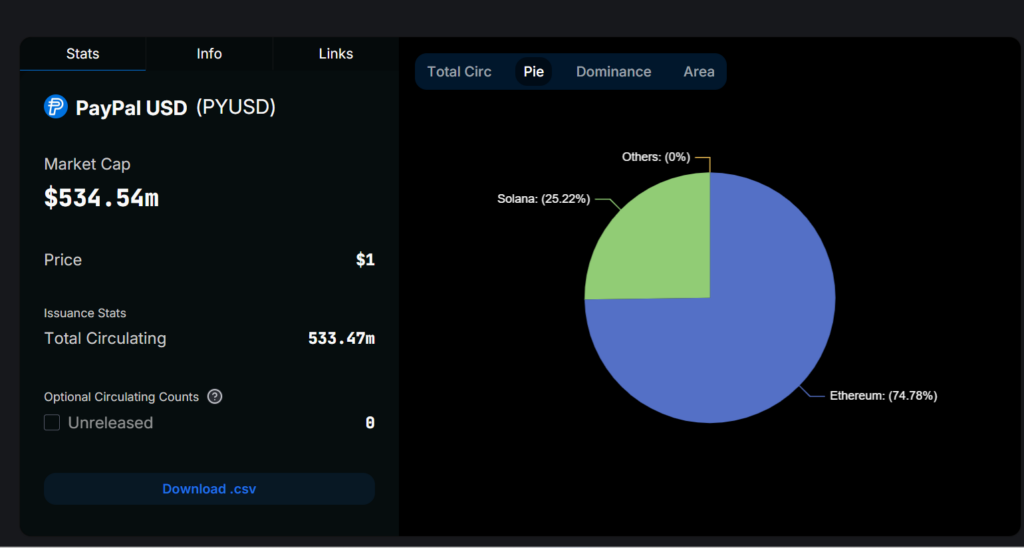

Since its rollout, PYUSD’s supply reached 230 million by the end of 2023. However, the total supply of stablecoins has more than doubled since then. Notably, the past month alone saw a 97% increase in supply, from 270 million on June 26 to over 533 million.

This growth has placed PayPal among the leaders in the stablecoin market, challenging established names like Tether USD.

Network Integrations Boost Growth

The stablecoin’s notable expansion on the Solana network has contributed significantly to its recent surge. Solana now hosts about 134.5 million PYUSD tokens, which accounts for 25.2% of the overall supply. Additionally, nearly 399 million PYUSD stablecoins are circulating on Ethereum.

The adoption of PYUSD on centralized exchanges such as Crypto.com and its integration into decentralized finance protocols like Curve and Frax have also played a crucial role in its rapid growth.

Moreover, the largest portion of PYUSD on Ethereum is held by Paxos, with 112 million tokens. This is closely followed by the Crypto.com exchange with 103 million. Other key holders include Defiance Capital with 35 million, BitGo with 14.8 million, and Curve with 14 million.

These strategic holdings and network integrations highlight PYUSD’s increasing prominence in the digital asset ecosystem.

PayPal’s PYUSD continues to expand its market presence, supported by strategic network integrations and robust market adoption. Its rapid rise in supply underscores its growing role in the digital economy, marking a phase of development for PayPal’s foray into the cryptocurrency space.

Also Read: MoonPay Enables PayPal for Crypto Transactions in UK and EU