Bitcoin (BTC) encountered renewed turbulence as Mt. Gox exchange initiated movements of long-frozen assets worth $6 billion, sparking concern and volatility across crypto markets.

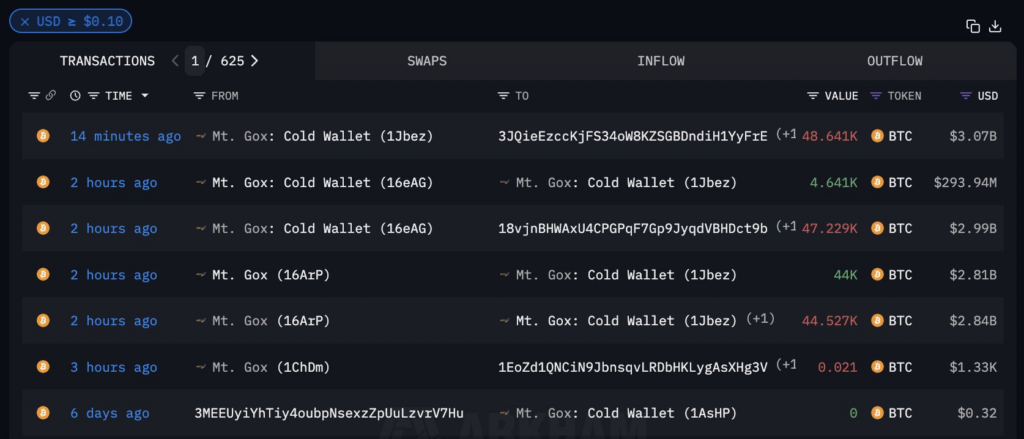

The saga began when blockchain data revealed that Mt. Gox, once the titan of Bitcoin exchanges before its collapse in 2014, had commenced internal transfers. Initially, a modest 0.021 BTC ($1,000) was test-transferred to address 1EoZd1QNCiN9JbnsqvLRDbHKLygAsXHg3V, hinting at larger maneuvers to follow.

Subsequently, a staggering 91,756 BTC ($5.8 billion) was shifted to an internal wallet, marking a significant step in what appears to be a repayment strategy.

Observers, including on-chain analysts like Lookonchain, speculate that these movements are part of Mt. Gox’s long-awaited creditor reimbursement plan. This plan, initiated on July 4, 2024, after a decade of legal battles and creditor frustrations, raises concerns about potential sell-offs by beneficiaries eager to recover lost investments.

On July 5, Bitcoin fell to $53,717, the lowest since February, after Mt. Gox transferred 47,228 BTC worth $2.71 billion.

Bitcoin, the bellwether of the crypto market, briefly dipped 3%, slipping below the $63,000 mark after touching $65,000 earlier in Asian trading hours.

Mt. Gox’s turbulent history serves as a stark reminder of Bitcoin’s evolution and challenges within the crypto ecosystem. The exchange’s collapse in 2014, following a devastating hack that saw hundreds of thousands of BTC vanish, remains one of the darkest chapters in Bitcoin’s narrative.

Also Read: Brace for Mt. Gox Creditors 99% Bitcoin Sell-off: Analyst