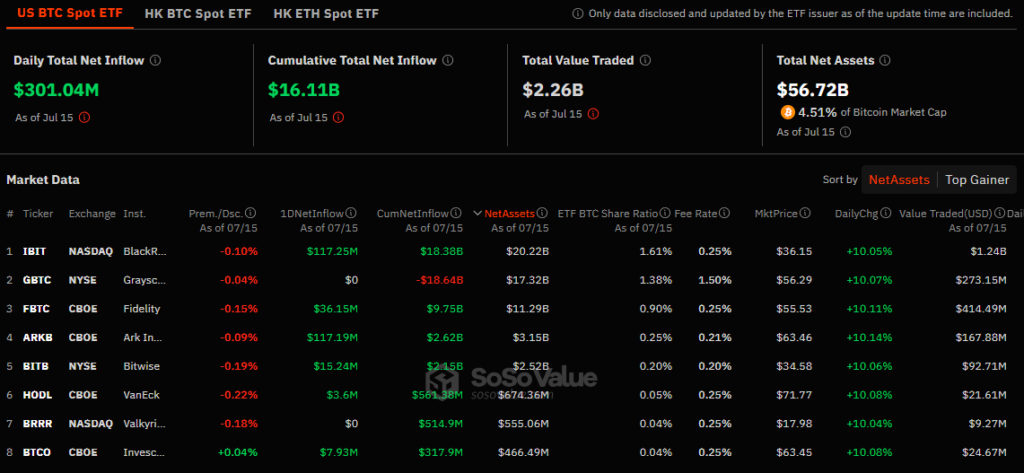

Spot bitcoin exchange-traded funds (ETFs) in the U.S. continued their positive streak, reporting a daily net inflow of $301 million, marking the seventh consecutive day of gains.

According to data from SoSoValue, BlackRock’s IBIT, the largest spot bitcoin ETF by net asset value, led the inflows with $117.25 million on Monday. It also topped the charts as the most traded bitcoin ETF, with a volume of $1.24 billion. Ark Invest and 21Shares’ ARKB closely followed with net inflows of $117.19 million.

Fidelity’s FBTC saw significant inflows of $36.15 million, while Bitwise’s BITB recorded $15.24 million worth of inflows for the day. VanEck, Invesco & Galaxy Digital, and Franklin Templeton also reported net inflows into their respective funds.

Overall, U.S. spot bitcoin funds saw a total trading volume of $2.26 billion on Monday, although this remains lower compared to the peaks seen in March when daily volumes exceeded $8 billion. Since their launch in January, these ETFs have accumulated a total net inflow of $16.11 billion.

Bitcoin’s price demonstrated resilience, exceeding $64,000 and currently trading at $64,770, while sources confirm the upcoming launch of spot ether ETFs on July 23, enhancing anticipation in the cryptocurrency ETF market.

BlackRock’s co-founder and CEO Larry Fink expressed a notable shift in perspective on Bitcoin during a CNBC interview on Monday, describing it as a “legitimate financial instrument” and admitting his earlier skepticism was misplaced.

BlackRock’s IBIT emerged as the top spot bitcoin ETF with substantial inflows, reflecting investor confidence amid ongoing market volatility.

Also Read: BlackRock Reaches Over $10.6T AUM Fueled by ETF Surge