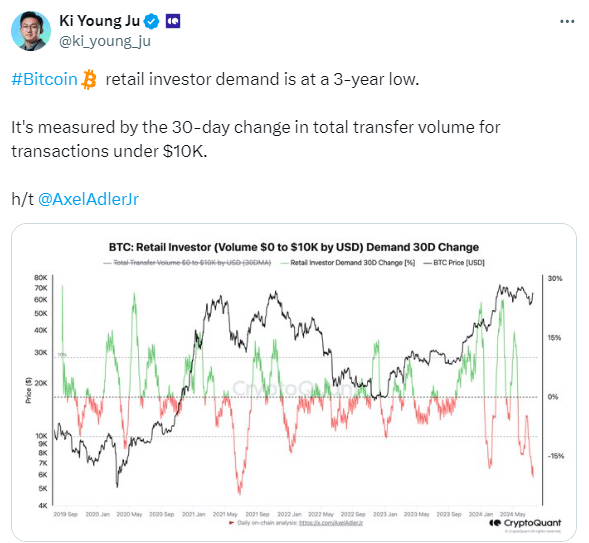

Bitcoin’s retail investor interest has dropped to its lowest level in three years, sparking concerns about whether a major price increase is on the horizon, due to a significant decline in transactions under $10K.

According to CryptoQuant founder Ki Young Ju, the average monthly change in demand from retail investors has dropped below -15% over the past 30 days. This metric, which tracks transactions under $10K, signals a sharp decline in retail engagement.

CryptoQuant contributor Minkyu Woo explained, “The real bull run typically begins with massive buying volume driven by retail investors.” Woo noted that past bull markets often saw a surge in retail activity, which boosted market sentiment. Currently, this volume is absent, leading to caution among analysts and traders.

Despite the downturn in retail interest, some believe that institutional investors are still active. VanEck CEO Jan van Eck previously noted that most inflows into U.S. spot Bitcoin ETFs are from retail investors. However, spot Bitcoin ETF inflows fell by 87% on July 17, totaling just $53.3 million across 11 tracked products, according to Farside.

Bitcoin’s price is also struggling to maintain a key support level. On July 17, Bitcoin briefly climbed to $65,686 but then retraced to $63,521. As of now, Bitcoin is trading at $63,975, according to CoinMarketCap data.

According to Google data, search interest for “Bitcoin” has dropped 44% over the past three months since the Bitcoin halved and nearly 57% from its peak of $73,679 on March 13. This decline highlights reduced retail investor enthusiasm, vital for sparking a major bull run.

As the market awaits a rebound in retail interest, the potential for a new Bitcoin bull run remains uncertain.

Also Read: Trump to Announce Bitcoin as USA Strategic Reserve Asset at Conference?