On July 23, the Finance Minister of India, Nirmala Sitharaman, will present the union budget for the financial year 2024-25. Traders, investors, businesses, salaried class and crypto lovers are keenly awaiting the significant announcements in this budget which will also mark as the first budget of the third term incumbent Prime Minister Narendra Modi’s government.

India’s cryptocurrency sector has experienced tremendous volatility since the global financial crisis and introduction of stringent tax and regulatory policies. Crypto industry leaders in India have regularly called for lower tax rates on cryptocurrency assets.

On Tuesday, as Finance Minister Nirmala will enter the house with red gladstone to declare major finance and taxation policies for the coming years, the desi crypto community will keep its eyes glued for any major announcements.

We, at The Crypto Times, spoke to a number of industry leaders and social media influencers related to crypto to understand their aspirations and expectations from the upcoming union budget of India.

Additionally, we will also present model cases of crypto taxation and regulations from all around the world to draw a comparative analysis with that of India.

What do Crypto Industry Leaders Expect from the Budget?

For the upcoming Union Budget, the crypto industry hopes for tax reductions, the ability to offset crypto losses against gains, and equal treatment of crypto capital gains with other assets.

In 2022, India imposed a 30% flat tax on cryptocurrency earnings. The sector faces uncertainty amid discussions of a potential ban on private cryptocurrencies, alongside continued taxation policy. Currently, cryptocurrency transactions in India are subject to a 1% Tax Deducted at Source (TDS). The industry has been divided over this high TDS rate, which has resulted in lower trading volumes and market activity.

Ashish Singhal – CoinSwitch

The industry hopes for a tax reduction to align with other asset classes, making crypto investments more attractive and equitable. There is also a call for offsetting losses against gains within the same financial year.

Co-founder of the cryptocurrency app CoinSwitch Ashish Singhal said that the Indian government needs to reevaluate how cryptocurrencies are taxed in the next budget to take full advantage of Web3 opportunities in India.

He raised concern over the current tax rate stating, “The flat rate of 30 percent applicable on income from the transfer of VDAs needs to be re-examined to ensure parity with other tech-enabled sectors. Additionally, the threshold of Rs 10,000 or Rs 50,000 can also be looked at. Most crypto sellers (mainly individuals) are in the low-income bracket. Increasing the threshold will reduce the administrative burden on the tax department in processing refunds.”

Shivam Thakral – BuyUcoin

Shivam Thakral, chief executive officer of BuyUcoin said that the Indian VDA market has declined over the past two years due to the 1 percent TDS and capital gains tax. He expects the upcoming budget to reduce these taxes to reasonable levels, providing a fair environment for businesses to thrive.

Sumit Gupta – CoinDCX

Additionally, CoinDCX co-founder Sumit Gupta proposed reducing the tax rate from 30% to 0.01% and lowering the TDS rate from 1% to 0.01%. He thinks that these adjustments would revitalize the cryptocurrency industry.

Moreover, CoinDCX has also submitted its requests and recommendations to the Government of India and was also part of the Bharat Web3 Association (BWA) delegation that met with Finance Ministry officials as part of pre-budget consultations. The platform has requested for a fair and equitable taxation in the VDA space.

In an official statement shared by CoinDCX they have included four key asks from the upcoming budgets

CoinDCX’s key asks include:

- To ensure a level playing field for the Indian VDA Industry vis-a-vis the offshore counterparts, we urge the government to expand the scope of the TDS mandate to explicitly include offshore platforms.

- Additionally, we advocate for a reduction in the TDS rate under Section 194S(1) from 1% to 0.01%, emphasizing the necessity of a tax-friendly environment to stimulate industry development.

- In pursuit of equitable taxation, we propose an amendment to Section 115BBH to reduce the tax rate from 30%, at par with assets in other industries.

- Further, we recommend revisiting the threshold limit for tax deduction under Section 194S, suggesting an increase from INR 10,000/INR 50,000 to INR 5,00,000, in coherence with the provisions in Section 194-O of the Act,” said an official statement from CoinDCX.

Ajay Kashyap – Crypto Influencer

The crypto industry is hoping for a reduction in the TDS rate, with suggestions to lower it to 0.01%. Adjustments to tax thresholds could also foster a more competitive and vibrant crypto environment.

Raising similar concerns, Ajay Kashyap, a prominent crypto influencer in India, says, “From this budget, the crypto community is primarily hoping for greater clarity on the taxation framework, particularly a potential reduction in the TDS rate from the current 1%, which many in the industry find prohibitive. The existing 30% tax on crypto gains, coupled with the 1% TDS, has created significant challenges for market participants, and there’s a palpable desire for some form of relief. Beyond taxation, there’s a pressing need for more defined guidelines and indications of a move towards a comprehensive regulatory framework. “

What Can India Learn from Global Models?

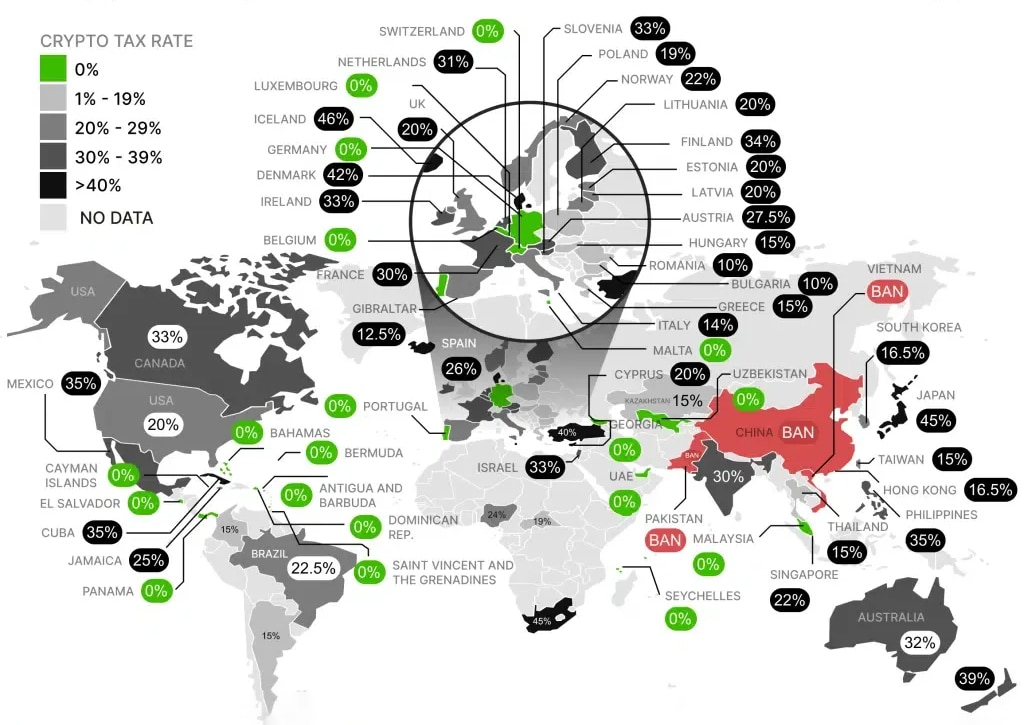

Examining how countries like the US, EU, Hong Kong, and Dubai regulate cryptocurrencies provides valuable insights for India to shape its regulatory framework.

The U.S. crypto industry has strongly objected to the United States Securities and Exchange Commission’s (SEC) regulatory strategy, which is based mostly on enforcement proceedings. Due to the lack of definite and uniform regulations, this enforcement-centric approach has prompted certain token innovators and cryptocurrency developers to relocate their base to execute their activities outside of the US.

On the other hand, the European Union (EU) has implemented extensive rules, such as the Markets in Crypto-Assets (MiCA) framework. The main objective of MiCA is to promote innovation in the cryptocurrency industry while offering regulatory certainty and transparency.

Hong Kong and Dubai have become crypto-friendly by creating clear rules that support innovation while overseeing regulations. They aim to attract crypto businesses and become global hubs for digital assets.

The impact of global regulatory frameworks on market participation and innovation has been criticized due to their perceived excessive rigidity or laxity. Particularly the US has come under fire for enforcing laws harshly and inconsistently without offering precise, uniform rules.

India can learn from these global examples to create a balanced regulatory environment that supports innovation while ensuring compliance and investor protection. Emphasizing the practical utility of blockchain technology beyond speculation can spur the creation of impactful solutions in various sectors.

WazirX Hack: Implications on the Indian Crypto Ecosystem

The recent security breach incident at WazirX crypto exchange, resulting in loss of upto $234.9 Million (approximately Rs 2000 crore), has dampened the spirits of the desi crypto community and raised concerns whether the government of India would introduce stricter regulations in near future.

The breach of WazirX, India’s largest crypto exchange, has put its 16 million users in limbo, as they cannot withdraw their funds nor take any legal course for the next 60 days. Even as the founders of WazirX have announced a bounty for recovering stolen assets, breach incidents like these halt the progress of crypto adoption in India and invites increased scrutiny from the authorities.

Conclusion: Would India go the Crypto way?

The upcoming Union Budget on July 23 is pivotal for India’s crypto industry. Led by Finance Minister Nirmala Sitharaman, potential tax reductions and clear regulatory guidelines could shape the sector’s future significantly.

The Modi government must support crypto innovation while ensuring growth and investor protection. Adopting a balanced regulatory approach, similar to the EU’s MiCA framework, can help foster innovation while protecting investors. Focusing on the practical applications of blockchain in finance, supply chain management, and public administration can drive broader adoption and economic benefits.

India has the chance to become a leading hub for cryptocurrency and blockchain technology by addressing these issues. With its market potential and technological capabilities, India can thrive in the global digital economy.

Also Read: Exclusive: Would Nirmala find love for crypto in her 2nd term?