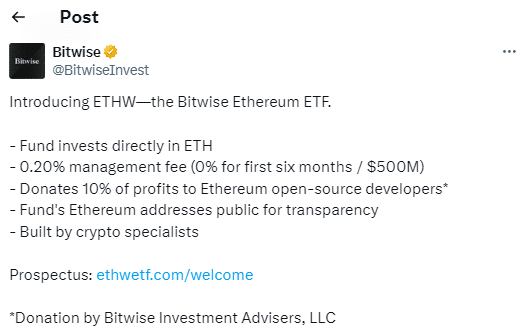

Bitwise Asset Management will provide 10% of the profits from the new Bitwise Ethereum ETF (ETHW) to the Ethereum Developers. The ETF, which starts trading on the New York Stock Exchange on July 23, tracks the Ethereum (ETH), the second by market capitalization cryptocurrency.

The ETF will offer direct exposure to Ethereum (ETH), the second-largest cryptocurrency by market cap. To start, ETHW will have a 0.20% management fee, waived for the first six months on the first $500 million of assets.

The donations will be made annually over the next ten years to organizations such as Protocol Guild and the PBS Foundation. Protocol Guild supports Ethereum’s core developers, while the PBS Foundation funds open-source block relays and related research.

Hong Kim, CTO of Bitwise, emphasized the importance of these contributions: “Ethereum is an open-source technology supported by a community of developers. Every ETHW investor wants Ethereum to grow, which is why we’re implementing this donation program.”

In addition to the donation announcement, Bitwise has disclosed that all ETHW holdings will be visible through Ethereum addresses. The launch of ETHW follows the success of the Bitwise Bitcoin ETF (BITB), which quickly amassed $2.7 billion in assets under management.

Matt Hougan, Bitwise CIO, noted that Ether ETFs could drive Ethereum to new highs by the end of 2024. He contrasted Bitcoin’s role as a monetary asset with Ethereum’s use in powering decentralized finance (DeFi), NFTs, and stablecoins.

Despite the positive news, Ethereum’s price fell 2.40% to $3,449, with a 2.35% drop in market cap to $414.8 billion, though trading volume surged 36% to $18.6 billion, and analysts forecast a potential rise to $5,000 with the ETF approval.

Bitwise’s ETHW ETF is a promising development, giving investors direct Ethereum exposure while contributing to Ethereum’s growth. The introductory fee waiver adds further appeal, enhancing the ETF’s value proposition.

Also Read: SEC Approves Spot Ethereum ETFs: Trading Starts July 23