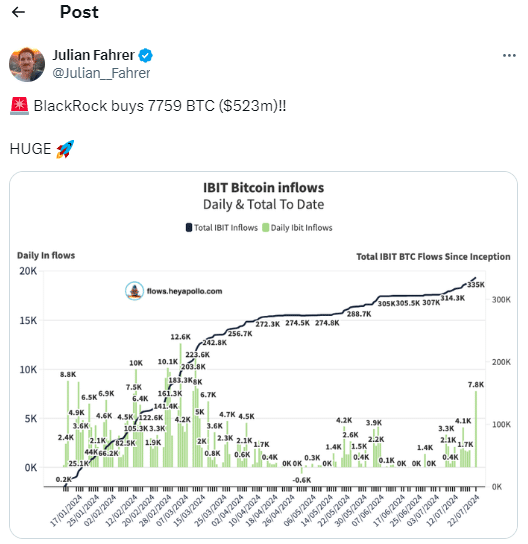

The world’s largest asset manager, BlackRock’s iShares Bitcoin Trust (IBIT), has recorded its biggest day of inflows in over four months. On July 22, the fund saw a massive $523 million influx, equating to 7,759 Bitcoin.

This substantial addition brings the total inflows into IBIT to 333,000 BTC, valued at around $22 billion at current prices. The July 22 inflow marks the seventh-largest single-day total in U.S. dollars for the fund, according to data from Hey Apollo shared by its co-founder on July 23.

For context, IBIT’s largest day of inflows occurred on March 18, when $849 million worth of Bitcoin was added. The second-largest was on March 5, with $788 million in inflows, as noted by FarSide investor data.

The timing of this significant inflow coincides with the approval of spot Ether ETFs for trading in the U.S. Analysts anticipate that spot Ether ETFs could attract 10% to 20% of the flows seen by spot Bitcoin ETFs since their launch in January.

Looking ahead, analysts are optimistic about Bitcoin’s price. They point to recent political developments, including President Biden’s withdrawal from the presidential race and the increased likelihood of Donald Trump’s victory, as potential catalysts for Bitcoin’s price growth.

Markus Thielen of 10x Research suggested that Trump might announce Bitcoin as a strategic reserve asset at the upcoming Bitcoin 2024 conference in Nashville on July 25, which could lead to a significant price surge.

Bryan Courchesne from DAIM also believes that Trump could solidify Bitcoin’s status as a strategic reserve asset, potentially driving Bitcoin’s price higher in the near future.

Also Read: BlackRock, Fidelity, ARK, VanEck Increase Crypto Holdings