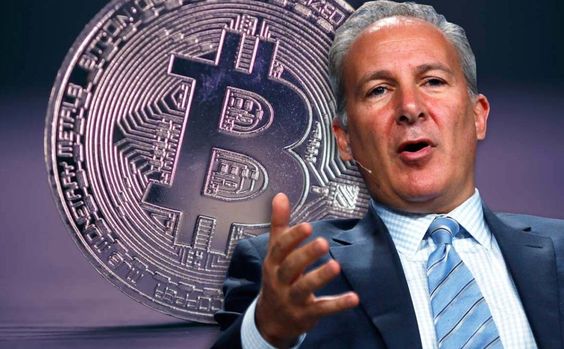

At the Bitcoin Conference 2024 yesterday, Independent presidential candidate Robert F. Kennedy Jr unveiled an ambitious plan to integrate Bitcoin (BTC) into the U.S. economy. However, this plan has been criticized by Peter Schiff, an economist and well-known critic of Bitcoin.

If elected President, Kennedy pledged to sign multiple executive orders on his first day in office, aiming to transform the nation’s approach to cryptocurrency.

He also outlined his plans for the Treasury to purchase 550 BTC daily until the U.S. accumulates a reserve of 4 million BTC.

However, Peter Schiff slammed Kennedy’s vision as a mere ‘vote-buying’ tactic. He accused Kennedy of pandering to BTC enthusiasts by promising to use taxpayer funds to purchase Bitcoin and eliminate income taxes on BTC gains.

He labeled the proposal as strategically flawed, asserting, “There’s nothing strategic about Bitcoin. No nation should own any as a reserve asset.”

Schiff’s critique goes beyond the immediate policy implications, arguing that Bitcoin does not offer the same benefits as a return to the gold standard, which he supports. He suggests that Kennedy’s promises are more about garnering votes than implementing effective policy, implying that even if Kennedy were to win, the plan might never be executed.

According to Polymarket, Kennedy’s chances of winning the presidency remain slim, with only a 1% chance of victory, while former President Donald Trump and Kamala Harris hold significantly higher odds at 59% and 40%, respectively.

The crypto community remains divided, as figures like Michael Saylor of MicroStrategy echo Kennedy’s vision of a U.S. BTC reserve.

Also Read: Tyler Winklevoss Urges U.S. Govt to Name Next SEC Chair Before Election