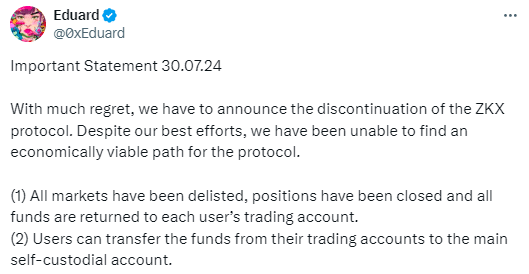

ZKX Protocol, a derivatives trading platform on Starknet, has shut down. Founder Eduard Jubany Tur announced the closure on July 31, saying there was no “economically viable path” for the protocol.

Tur cited minimal user engagement and decreased trading volumes as key reasons for the shutdown. He noted that only a few users were participating in the protocol’s rewards program, and daily revenue couldn’t cover their cloud server expenses.

All markets have been delisted, positions closed, and funds returned to users’ trading accounts. Users have until the end of August to transfer their funds from trading wallets to the protocol’s main self-custodial account.

Tur said, “The sunset period will last until the last day of August. ZKX vesting and distribution will continue after sunset on September 1st.”

This closure follows a $7.6 million strategic funding round on June 19, with contributions from investors like Flowdesk, GCR, and DeWhales. Previous investors included Hashkey, Amber Group, Crypto.com, and StarkWare.

Despite the recent funding, the protocol struggled with the value of its ZKX token. Tur admitted that the token generation event (TGE) did not meet expectations, leading to financial losses. Major token holders cashing out further contributed to the token’s declining value.

Tur also pointed to the “broader exhaustion” in the decentralized finance (DeFi) sector as a factor in the decision to shut down.

The ZKX token price fell 33.72% in the last 24 hours, now trading at $0.02 according to CoinMarketCap data. The token has dropped 96.4% from its all-time high of $0.62, which it reached a day after its launch on June 20.

ZKX Protocol’s shutdown highlights the challenges faced by DeFi platforms amid declining user engagement and token value. Despite recent funding, the protocol could not sustain operations in the current market environment.

Also Read: BitForex to Resume Withdrawals After 5-Month Shutdown