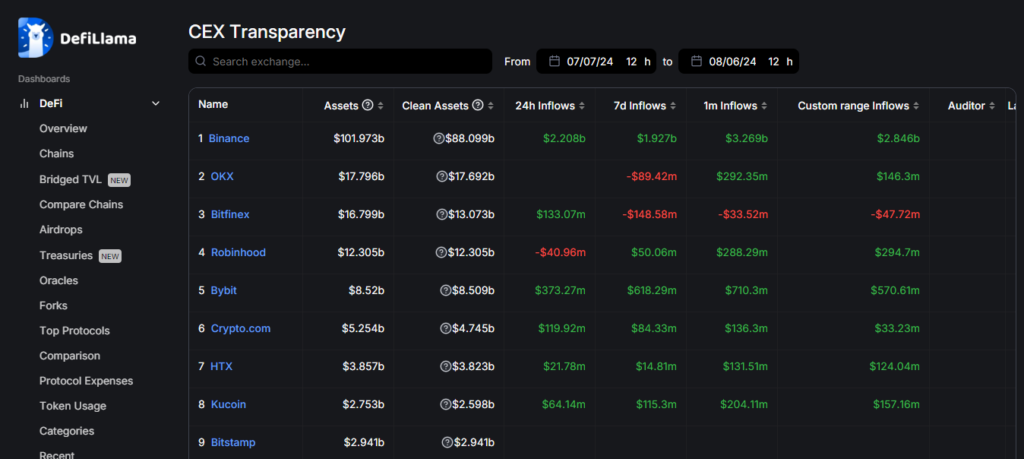

Binance, the largest cryptocurrency exchange globally, saw a noteworthy net inflow of $2.208bn in the last 24 hours, based on DeFiLlama’s CEX Transparency measurements.

Despite recent volatility, customers’ faith in Binance and optimism about the cryptocurrency market’s future are reflected in the significant capital inflow, according to DeFiLlama. The figure is way above the inflows its major rivals, including OKX and Bybit, are pulling in.

In light of Changpeng Zhao’s resignation and a significant U.S. penalty, Richard Teng, the recently hired CEO, noted that this inflow is among the largest for 2024.

Teng thinks that despite previous market downturns, this shows that investors are still confident and that they are willing to buy assets at reduced prices. He also mentioned the day’s record trading volumes and a noteworthy recovery in the values of the major tokens.

In January, Binance attracted $3.5 billion in inflows, just months after facing legal issues and paying a $4.3 billion fine for illegal activities without liquidating crypto assets.

However, Teng’s leadership faces several hurdles, including establishing a global headquarters, securing full licenses in major crypto hubs, and addressing ongoing legal challenges, such as the SEC lawsuit against Binance’s U.S. affiliate.

Additionally, Binance has faced regulatory setbacks, with India recently blocking access to its app and other countries cracking down on the exchange for operating without necessary permits.

Also Read: India’s DGGI Hits Binance with $86.88M (₹722 Cr) GST Notice