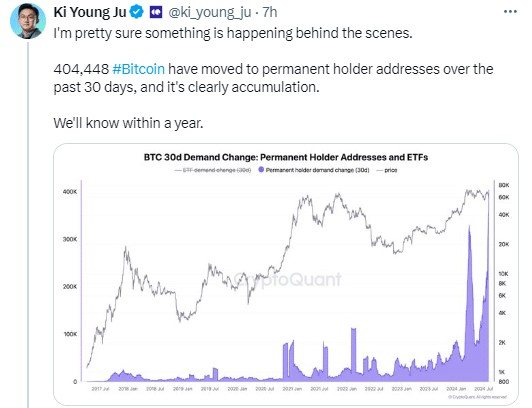

Bitcoin permanent holder addresses have accumulated nearly $23 billion worth of BTC over the past month, according to on-chain data. Ki Young Ju highlighted this significant 30-day spike in Bitcoin demand in a post on X on August 7.

Specifically, around $22.8 billion, or 404,448 BTC, have recently shifted to permanent holder addresses. Ki Young Ju warns that retail investors might regret not buying now as major institutions could announce significant Bitcoin acquisitions by Q3 2024.

Ki Young Ju also pointed out other bullish indicators. He mentioned that miner capitulation is nearly over, with Bitcoin’s hash rate approaching all-time highs. U.S. mining costs are around $43,000 per Bitcoin, suggesting stability unless prices fall below this level.

Ki Young Ju noted that retail investors are largely absent, similar to mid-2020, and old whale activity has reduced, with long-term holders selling between March and June but showing no significant selling pressure now.

Based on these observations, Ki Young Ju believes the bull market remains intact. However, he stated that if the market doesn’t recover in two weeks, he will reconsider his stance, as it could indicate that new whales are either misguided or have underestimated the macro environment.

After a slump on August 5 that saw Bitcoin drop to $52,000, the asset has surged 14% to $57,000 as of August 6. Currently, Bitcoin is trading up 1.7% at $56,836, and the Fear and Greed index has improved to 29.

Ki Young Ju’s observations suggest a strong accumulation trend among Bitcoin’s permanent holders, signaling potential future announcements from major institutions. Retail investors might face regret if they miss this opportunity before significant acquisitions are revealed.